Ohio Energy Report: September 2023

Enbridge to Buy East Ohio Gas Company, Two Other Utilities from Dominion Energy Inc.

On September 5, 2023, Dominion Energy, Inc. (“Dominion”) announced that it entered into an agreement to sell the East Ohio Gas Company to Enbridge Inc., a Canadian pipeline operator. Enbridge will also acquire Questar Gas and the Public Service Company of North Carolina from Dominion in the $14 billion acquisition. This sale has effectively made Enbridge the largest natural gas utility in North American, by volume.

Regulatory approvals will likely delay the official acquisition and formal corporate transition until 2024. It is expected that nothing will change related to service or billing for customers of East Ohio Gas until that time.

In a conversation with Cleveland.com, Matt Brakey advised customers that there should not be any material changes in how they use and purchase gas. It should be business as usual for the foreseeable future.

Peak Loads for Summer 2023

For customers with electric generation contracts that pass through capacity, capacity costs are allocated according to each customer’s share of the load during PJM’s five regional load peaks (known as “Capacity Coincident Peaks,” or “Capacity CPs”). Likewise, for customers participating in FirstEnergy’s (FE) or AEP’s transmission pilot programs, transmission costs are primarily allocated according to each customer’s share of the load during FE’s or AEP’s respective zonal load peaks (known as “Transmission CPs”). By actively managing load during potential CP events, these customers can mitigate future capacity and transmission costs.

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission CPs to those clients that elect to receive them. As of September 21, 2023, Brakey Energy has issued eight Capacity CP alerts and ten FE Transmission CP alerts. We did not issue any AEP Ohio CP alerts during Summer 2023.

As we have noted before, the summer of 2023 was a surprisingly mild one in Cleveland and nearby cities within the ATSI Zone. We are approaching the end of the summer CP season and Cleveland has registered only two days where the recorded temperature was at least 90°F. Compare this to a total of 7 and 13 days in 2021 and 2022, respectively. The last time there was a summer with fewer than two days above 90°F in Cleveland was 2004.

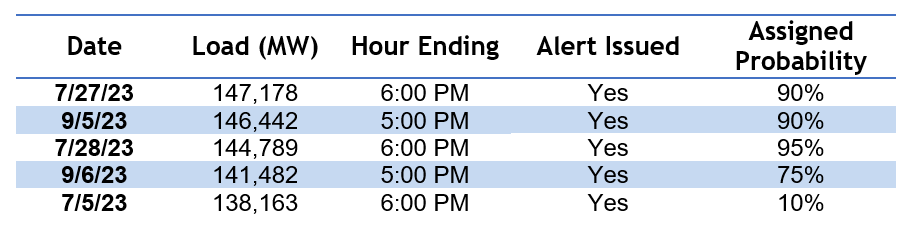

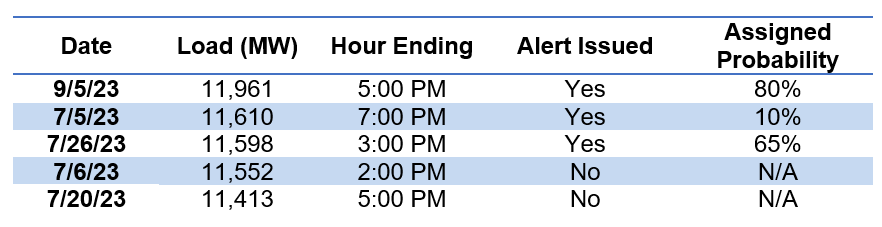

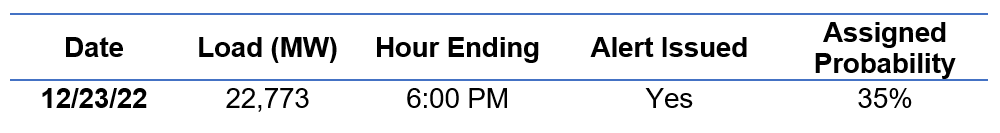

The tables below list PJM’s and FE’s five highest 2023 summer loads and AEP’s single highest load since November 1, 2022, as well as the day and time of each occurrence. This is based on preliminary data.

Table 1: Five Highest Summer Loads for PJM through September 20, 2023

Table 2: Five Highest Summer Loads for FE through September 20, 2023

Table 3: Single Highest Load for AEP through September 20, 2023

Although we were able to provide notice in advance of all PJM CP events, we did not predict the FE Transmission CP events that occurred on July 6 and July 20. Rather shockingly, with the exception of the CP on September 5, 2023, the loads on each of the remaining four CPs are below any and all ATSI Zone CPs registered previously. Prior to this year, the lowest recorded ATSI Zone CP was 11,834 MW, which registered on July 20, 2017.

Based on current weather forecasts, we do not anticipate any further potential CP events for the year. PJM can adjust metered load data for up to 90 days. Brakey Energy will continue to monitor metered loads and will provide an update on the Capacity and Transmission CPs once they are finalized by PJM.

If you would like to know how your performance during the Capacity and/or Transmission CPs mentioned above will impact your future electric costs, please contact Katie Emling.

Electric Costs Changing on October 1 for FE SSO Customers

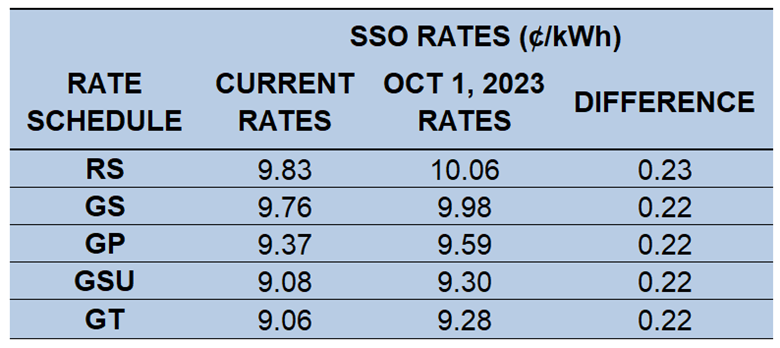

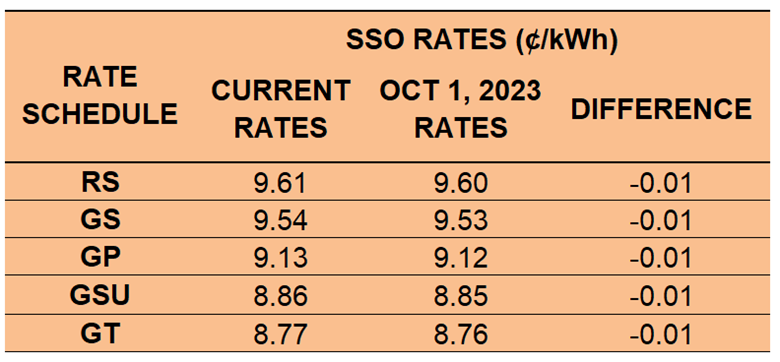

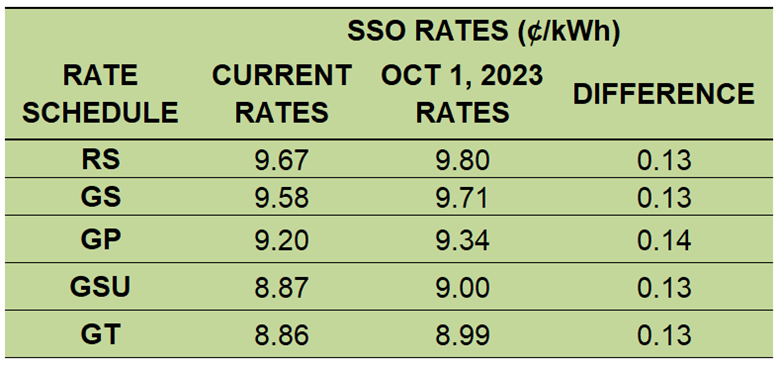

Electric costs will be increasing slightly on October 1 for Ohio Edison (OE) and Toledo Edison (TE) customers that take electric generation service under the utilities’ Standard Service Offer (SSO). The Illuminating Company’s (CEI) SSO rate will remain approximately the same. The SSO is the default rate charged by the utility for generation services to customers that do not contract with an alternative supplier. The SSO generation rate is higher during the three summer months of June, July, and August than it is during the other nine months of the year.

The current and October 1, 2022 SSO rates per kilowatt hour (kWh) for customers served under OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. These rates will change again on January 1, 2024.

Table 4: OE SSO Rates

Table 5: CEI SSO Rates

Table 6: TE SSO Rates

If you are not receiving electric generation service from an alternative supplier and would like more information about how FE’s SSO rate update will impact your monthly electric costs, please contact Katie Emling.

Residential Corner

The best offer we are currently seeing is from Better Buy Energy for 15 months at a rate of 5.69¢/kWh. This is unchanged from last month.

Regarding natural gas, if you entered into a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted prior to this past winter, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market – especially through the fall. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

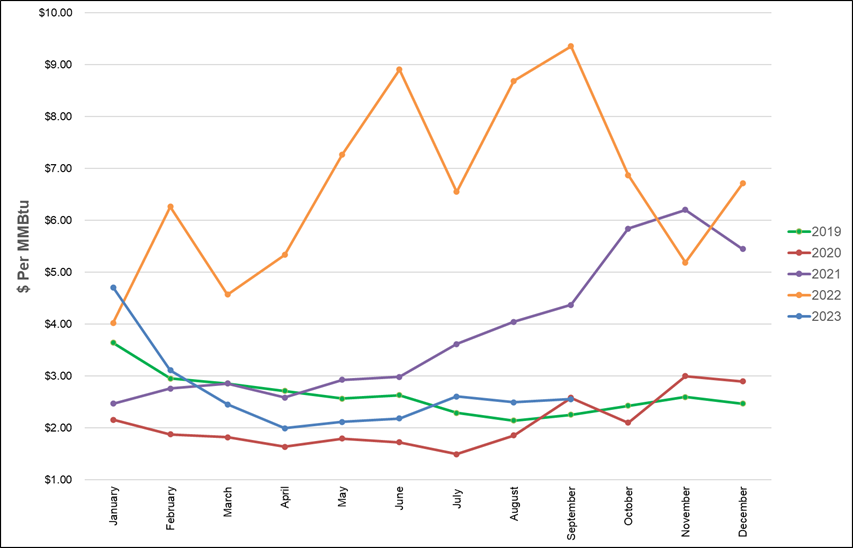

The NYMEX price for September settled at $2.556 per Million British Thermal Units (MMBtu) on August 29, 2023. This price is up 2.6% from August’s price of $2.492 per MMBtu. This settlement price is used to calculate September gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2019, 2020, 2021, 2022, and 2023 to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

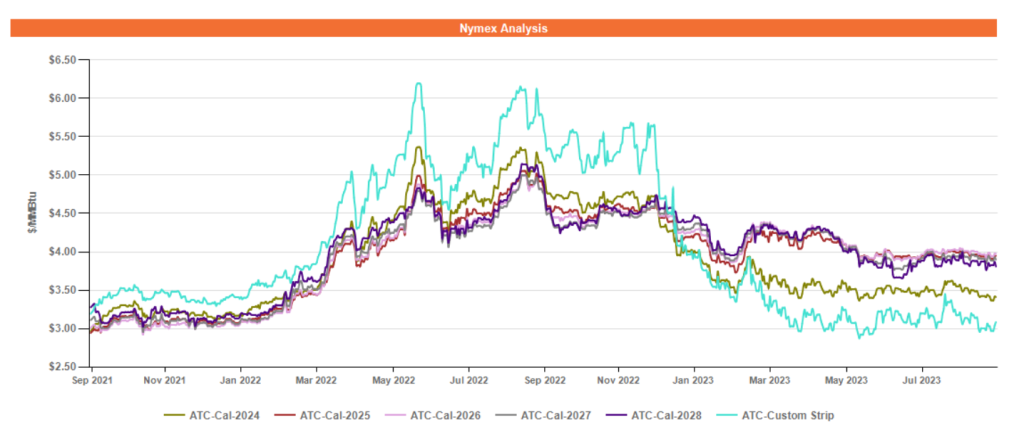

Figure 2 below shows the historical September 21, 2021 through September 21, 2023 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028. Natural gas prices for the balance of 2023 and calendar year 2024 continue to trade at lower levels compared to outlier years. Prices for outlier years are hovering just south of $4.00 per MMBtu.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Electricity Market Update

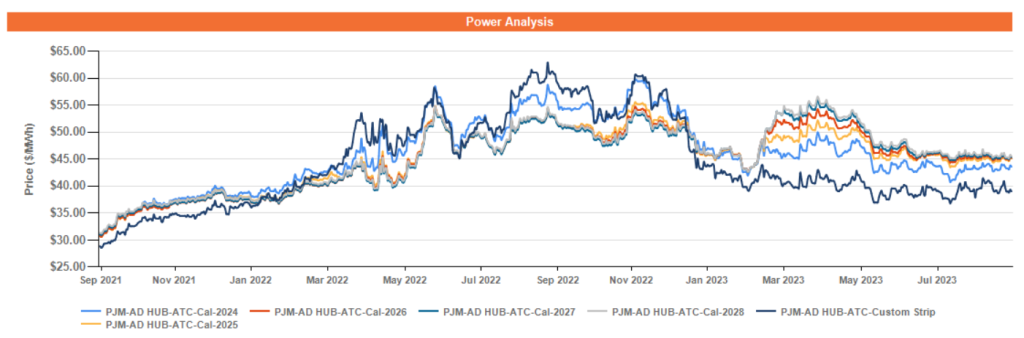

Figure 3 below shows the historical September 21, 2021 through September 21, 2023 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028 for the AD Hub. Like gas, the power market finds itself in a state of contango. Forward prices for calendar years 2025 through 2028 are hovering right around $45.00 per MWh and prices for the balance of 2023 and calendar year 2024 are trading south of that level.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.