Ohio Energy Report: October 2024

PJM Files Request with FERC to Delay 2026/2027 BRA

On October 15, 2024, PJM Interconnection (PJM) submitted a motion to the Federal Energy Regulatory Commission (FERC) requesting a six-month delay for the currently scheduled Base Residual Auctions (BRA) and Incremental Auctions (IA) for the 2026/2027 Delivery Year (DY) through the 2029/2030 DY.

The table below summarizes the upcoming BRAs and IAs currently scheduled for the 2026/2027 DY through the 2029/2030 DY, along with PJM’s proposed auction dates should FERC approve its motion. A six-month delay for the upcoming BRA would have a cascading effect on subsequent auctions, with some IAs cancelled outright. Notably, PJM’s motion does not impact the Third IA for the 2025/2026 DY, scheduled to open on February 26, 2025.

Table 1: Illustrative Schedule for BRAs and IAs for 2025/2026 Through 2029/2030 DY

PJM’s motion was filed in response to a September 27, 2024 complaint filed with FERC by the Sierra Club, supported by four additional public interest organizations. The complaint challenges what they consider to be unjust and unreasonable capacity market rules regarding the resource adequacy value of generators operating under Reliability Must Run (RMR) arrangements. The Sierra Club states that “RMR arrangements require consumers to pay power plants that would otherwise retire to stay online to maintain reliability. Yet PJM does not accurately account for these RMR units’ contributions to resource adequacy during capacity auctions.” The complainants assert that PJM’s RMR rules resulted in $4 billion to $5 billion in excessive costs for consumers in PJM’s 2025/2026 BRA.

While PJM requests that FERC deny the complaint, it explained in its motion that the request to delay the upcoming auctions for DYs starting with 2026/2027 by six months is intended to give FERC time to review PJM’s planned filing, which will address the issues raised in the Complaint. In the meantime, as PJM awaits FERC’s ruling on its motion, it is proceeding with pre-auction planning for the upcoming BRA scheduled for December 2024.

FE Transmission Pilot Program Expansion Queue Still Open, AEP Ohio’s Queue to Open December 1

In the Public Utilities Commission of Ohio’s (PUCO) decision regarding FirstEnergy’s (FE) Fifth Electric Security Plan (ESP V) case, the PUCO ordered FE to reopen enrollment for its Non-Market-Based Services Rider (Rider NMB) Pilot Program for 100 MW of non-residential load. On August 19, FE opened enrollment in the Rider NMB Pilot Program using a first-come, first-served queue process, allowing any non-residential customer with a 2024 Network Service Peak Load (NSPL) value of 20 Megawatts (MW) or less to participate. A customer’s NSPL value is calculated as the average load during the ATSI Zone’s five transmission coincident peaks (5 CPs) from the previous summer, adjusted for line losses and weather normalization.

Similarly, enrollment for AEP Ohio’s Basic Transmission Cost Rider (BTCR) Pilot Program is set to begin on December 1, 2024, also through a first-come, first-served queue process. This expansion follows a PUCO-approved settlement stipulation in AEP Ohio’s ESP V case that allows for an increase of 100 MW each program year within AEP’s ESP V term (June 1, 2024 – May 31, 2028), starting on April 1, 2025. Existing AEP non-residential customers eligible for the pilot program will have until December 31, 2024, to enroll, with participation starting on April 1.

Customers who enroll in FE’s Rider NMB Pilot Program or AEP’s BTCR Pilot Program may experience a reduction in transmission charges based on their consumption patterns during FE’s 5 CPs or AEP’s 1 CP each year. Instead of being billed monthly transmission charges based on FE’s Rider NMB rate or AEP Ohio’s BTCR rate on a monthly billed demand basis, pilot program participants will be charged based on their NSPL value. Non-weather-sensitive customers, those who operate primarily off-peak, or those who can schedule around potential grid peaks should consider whether the pilot program is suitable for their needs.

For more information on FE’s or AEP Ohio’s transmission pilot program and each utility’s enrollment queue process, please contact Katie Emling.

Ohio’s Electric Utilities Hold October SSO Auctions

On October 1, 2024, FirstEnergy (FE) held its second Standard Service Offer (SSO) auction for the 2025/2026 Delivery Year (DY). The auction secured 25% of FE’s SSO load for the upcoming DY and cleared at a price of 8.542¢ per kilowatt-hour (kWh), which is approximately 9% higher than the average clearing price from FE’s first SSO auction in March 2024 that secured 50% of its load for the same DY. In early 2025, FE is expected to hold the final SSO auction to secure supply for the last 25 tranches of SSO load through a 24-month product.

AES Ohio held its first SSO auction for the upcoming DY on October 15, 2024. This auction secured 50% of AES Ohio’s SSO load, clearing at a price of 8.805¢ per kWh, an increase of more than 1.7¢ per kWh compared to its last SSO auction held in April 2024 for the current DY. AES Ohio will hold at least one additional SSO auction in early 2025 to procure power supply for the remaining 50 tranches of SSO load before the next DY begins on June 1, 2025.

AEP Ohio has scheduled its first SSO auction for the upcoming DY on October 29, 2024. During this auction, AEP Ohio aims to procure supply for 50% of its SSO load, with the remaining 50% expected to be secured in a subsequent auction on March 4, 2025.

Duke Energy Ohio, which has its next Electric Security Plan pending before the Public Utilities Commission of Ohio, has yet to announce the schedule for its SSO auctions related to the 2025/2026 DY.

Brakey Energy will continue to monitor the SSO auctions for FE and other Ohio electric distribution utilities (EDUs), reporting outcomes in future newsletters. If you have any questions about the SSO auction process or SSO rates for FE or any of Ohio’s EDUs, please contact Katie Emling.

Carolyn Campaign Update

With just one week until Election Day, Carolyn is in the final sprint of her Geauga County Commissioner race. She’s crisscrossing Geauga, attending events like Saturday night’s Chardon Rotary fundraiser dinner. Check out Carolyn’s campaign newsletter that went out this morning, and don’t forget to send her some well wishes as the big day approaches.

Photo: Carolyn & Matt Brakey at the Chardon Rotary’s 32nd Annual Harvest Auction

Residential Corner

The sky-high BRA auction clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. Customers looking to hide on a low short term rate can contract with AEP Energy for six months at 5.55¢ per kWh.

Customers wanting longer term price certainty can snag a 12-month offer with Energy Harbor for 6.29¢ per kWh. Unfortunately, absent a major crash in energy prices, residential ratepayers are going to be looking at significantly higher rates for periods that include summer of next year and beyond.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

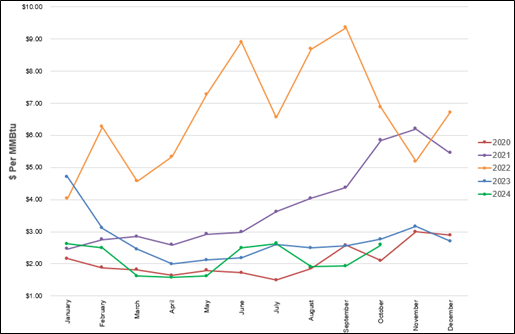

The NYMEX price for October 2024 settled at $2.585 per Million British Thermal Units (MMBtu) on September 26, 2024. This price is up approximately 34% from the September 2024 price of $1.930 per MMBtu. This settlement price is used to calculate October gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

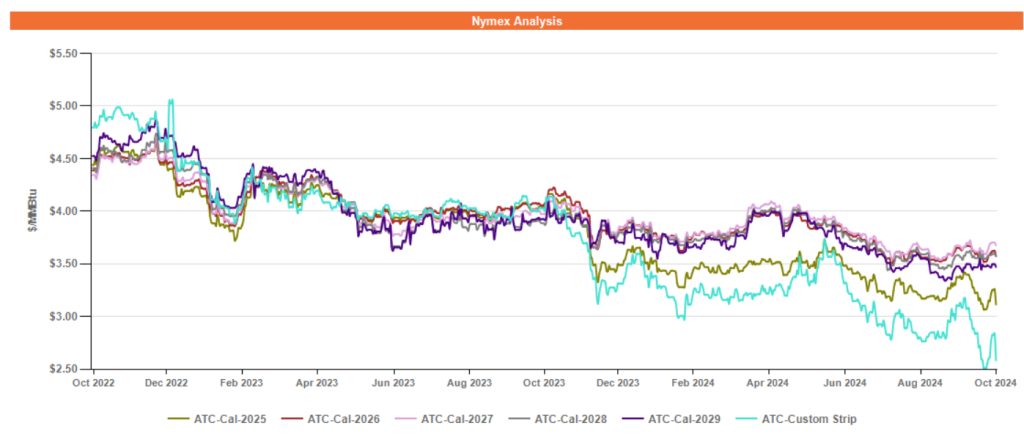

Figure 2 below shows the historical October 29, 2022 through October 29, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Price action in the forward gas market has closely followed trends in production and underground storage since the latter half of summer. The previous two winters’ unseasonably mild weather resulted in a significant storage surplus compared to historical averages, which has softened forward gas prices. Additionally, delays at major liquefied natural gas (LNG) export hubs have kept gas in the domestic market that would otherwise be exported, further contributing to the decline in forward prices, particularly through 2025. The U.S. Energy Information Administration projects that underground storage levels will reach their highest point since November 2016 by the end of the injection season in October.

Market participants will be closely monitoring weather patterns and meteorologists’ forecasts for the upcoming winter. Current predictions indicate milder temperatures compared to historical averages, although overall, cooler temperatures and higher precipitation are expected compared to the previous winter.

Electricity Market Update

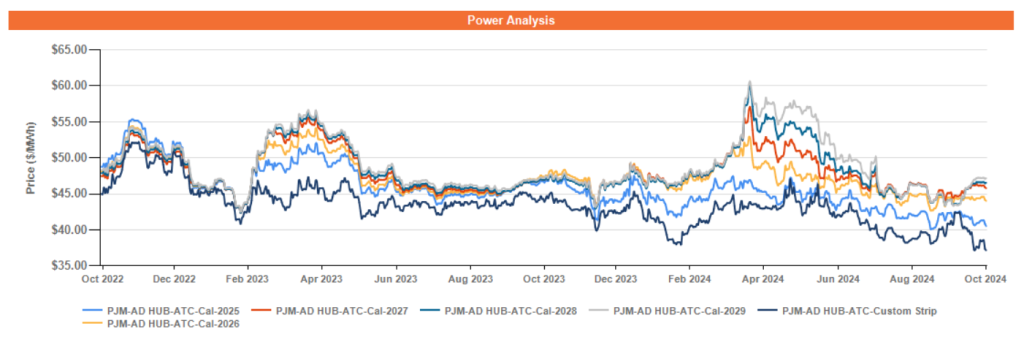

Figure 3 below shows the historical October 29, 2022 through October 29, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Price action in the forward power market over the past month has bifurcated between the short term, through May 2026, and the long term, from June 2026 onward. Forward power prices through May 2026 have remained soft, trading at or near two-year lows since summer, while prices from June 2026 onward have begun to trend higher, especially following PJM’s recent announcement to delay the BRA for capacity for the 2026/2027 delivery year from its original December 2024 schedule.

PJM has received complaints from several organizations, including the Organization of PJM States, Inc. (OPSI) and its independent market monitor, regarding the structural changes implemented in the most recent BRA. These organizations believe these changes contributed to record-high capacity clearing prices. Elevated capacity rates can depress forward power prices since generators can recover their costs through increased capacity payments rather than relying primarily on electricity generation. PJM’s decision to reconsider these auction structure concerns and delay the next BRA has introduced uncertainty about future capacity rates, leading to the formation of a risk premium in forward power prices from June 2026 onward.