Ohio Energy Report: November 2024

Carolyn Brakey Wins Geauga County Commissioner Seat in Landslide Victory

On November 5, voters overwhelming chose Carolyn Brakey as their next Geauga County Commissioner. Carolyn secured 33,849 votes to her opponent’s 17,474, a nearly 2-to-1 margin. Her vote total was the highest among all contested county-wide races, even surpassing President Trump’s Geauga County vote count, despite being further down the ballot.

Carolyn extends her heartfelt thanks for the incredible support from Brakey Energy clients and professional contacts. Your backing made a significant difference in her campaign. If you’d like to send Carolyn a congratulatory message, she’d love to hear from you. And for those who generously donated to her campaign, keep an eye out for an invitation to an upcoming pancake-themed victory party!

FirstEnergy Withdraws ESP V

In a move that may have significant consequences for ratepayers, FirstEnergy (FE) surprisingly withdrew its Fifth Electric Security Plan (ESP V) by filing a Notice of Withdrawal with the Public Utilities Commission of Ohio (PUCO) on October 29, 2024. Under Ohio law, FE has the right to withdraw a modified ESP following the PUCO’s approval with modifications, which were issued in its May 15, 2024 Opinion and Order.

According to Ohio Law, if a utility terminates an ESP application or the PUCO disapproves of an ESP application, “the commission shall issue such order as is necessary to continue the provisions, terms, and conditions of the utility’s most recent standard service offer, along with any expected increases or decreases in fuel costs from those contained in that offer, until a subsequent offer is authorized.”

Based on a precedent set by the PUCO’s Finding and Order in August 2016 regarding AES Ohio’s ESP II, the PUCO ordered AES Ohio to revert to its ESP I after AES Ohio withdrew its ESP II. The PUCO ruled in a similar manner in 2019 when AES Ohio withdrew its ESP III, ordering the utility to continue the provisions, terms, and conditions of the utility’s previous ESP.

Should the PUCO follow the precedent established through AES Ohio’s ESP cases, FE would revert to its ESP IV and any new programs or riders established by ESP V would terminate. For customers participating in FE’s Economic Load Response (ELR) program, a reversion to ESP IV would mean that ELR credits would return to $10 per kilowatt of curtailable load.

For customers participating in FE’s Non-Market-Based Services Rider (Rider NMB) Pilot Program (the “Transmission Pilot Program”), a reversion to ESP IV would not impact customers enrolled in the program prior to June 1, 2024. However, customers who enrolled in the Transmission Pilot Program through the ESP V expansion face participation uncertainty.

If you are a FE customer and have questions about how you may be impacted if FE reverts to its ESP IV, please contact Katie Emling.

CPP Rates to Increase in January

On November 4, 2024, Cleveland City Council (“Council”) voted in favor of increasing electric rates for Cleveland Public Power (CPP) customers. In particular, Council voted in favor of amending, repealing, and enacting new sections of Codified Ordinance Chapter 523 – Rules and Rates for the Division of CPP. The newly approved rates will go into effect starting on January 1, 2025 for all residential customers and non-residential customers, except those under contract through the Capacity Enhancement Incentive Rate Schedules prior to January 1, 2025.

In addition to rate increases to current fixed-rate monthly charges, kilowatt-hour charges, demand charges, and reactive demand charges, CPP’s Energy Adjustment Charge will be renamed the Power Supply Recovery charge, and the new rate schedules called the Commercially Contracted Alternative Rate Schedules will go into effect January 1, 2025.

The Commercially Contracted Alternative Rate Schedules — apparent successors to the Capacity Enhancement Incentive Rate Schedules — may apply to (1) commercial customers that have not received service from CPP in the past two years and enter into a minimum ten-year contract for service or (2) existing CPP commercial customers that enter into a minimum five-year contract.

If you are a CPP customer and have questions about how you may be impacted by the upcoming rate increases, please contact Katie Emling.

Take Steps This Winter to Mitigate Your Transmission Costs

Eligible electric customers in the service areas of American Electric Power (AEP), FE, and AES Ohio can decrease transmission costs by lowering their demand on specific days of the year when loads peak across a transmission zone, known as Transmission Coincident Peaks (Transmission CPs). Under transmission pilot programs, a customer is charged for transmission based on its power usage during those hourly Transmission CPs, rather than the default method of charging for transmission based on its monthly billed demand.

For the 2026 calendar year, transmission charges for transmission pilot program customers will be calculated based on the customer’s demand during the Transmission CPs occurring during the 12 months ending October 31, 2025. Historically, Transmission CPs in FE and AES Ohio service territories have occurred exclusively during the summer months; however, the single-hourly CP (1 CP) in the AEP Zone has also seen winter peaks.

Six times over the past 14 years, AEP’s 1 CP has occurred during the winter months, with 67% of those 1 CPs occurring during the hour ending (HE) 8:00 AM Eastern Standard Time (EST).

We recommend that AEP customers currently enrolled in AEP’s transmission pilot program take steps this winter to curtail load in response to potential Transmission CPs, especially during the HE 8:00 AM EST on potential 1 CP days.

To assist customers in their efforts to reduce demand during Transmission CPs, Brakey Energy has devised an alert notification system. This is a service available only to Brakey Energy clients. Participating clients can modify their registration preferences by emailing Catherine Catherine Nickoson.

Residential Corner

The sky-high Base Residual Auction clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. Customers looking to hide on a low short term rate can contract with AEP Energy for six months at 5.49¢ per kWh.

Regarding natural gas, if you entered a fixed-price residential natural gas contract without an early termination fee — such as those Brakey Energy has previously highlighted — you should consider exiting the contract and either (1) entering a new agreement or (2) defaulting to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

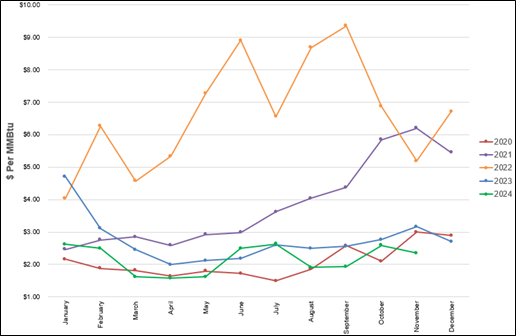

The NYMEX price for November 2024 settled at $2.346 per Million British Thermal Units (MMBtu) on October 29, 2024. This price is down approximately 9.2% from the October 2024 price of $2.585 per MMBtu. This settlement price is used to calculate November gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

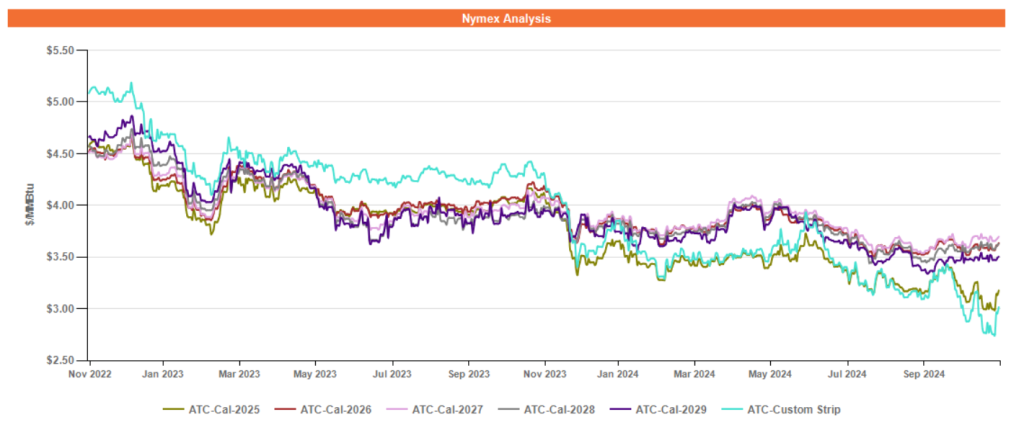

Figure 2 below shows the historical November 15, 2022 through November 15, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for December 2024 through the First Quarter of 2025 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Despite the recent rally due to production curtailment in the Gulf from Hurricane Rafael, forward natural gas prices for Calendar Year 2025 and Winter ’24/’25 have continued to soften and trade at or near 2-year lows. As injection season comes to a close, natural gas in storage sits at just under 4 trillion cubic-feet (TCF), near the all-time record of 4.1 TCF set in November 2014, and 6.1% above the 5-year average.

Price volatility in gas forwards may increase with changing weather forecasts for the upcoming winter. The consensus from meteorologists continues to call for a relatively mild winter, though cooler than the previous two. Additionally, meteorologists expect a La Nina event to take place over the winter, which can bring cold blasts and frigid temperatures from the Northwest. Winter storms Elliot and Uri in 2022 and 2021 both occurred during La Nina winters.

Electricity Market Update

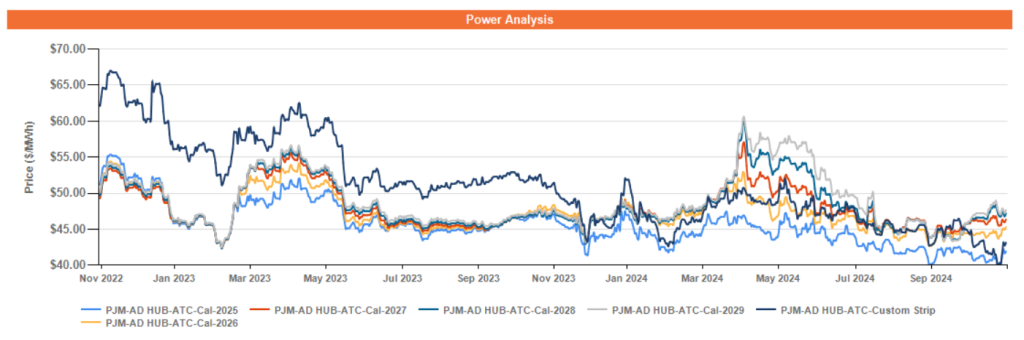

Figure 3 below shows the historical November 15, 2022 through November 15, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for December 2024 through the First Quarter of 2025 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.

Forward power prices have followed a similar trend to forward gas prices for Calendar Year 2025 and Winter ’24/’25, trading near 2-year lows but recently rallying in response to lower gas production from Hurricane Rafael. Forward power prices in outlier years 2026 and beyond continue to trade higher than 2025, as market participants closely monitor developments in PJM’s capacity auction structures and schedules.

Market participants also await PJM’s annual demand forecast, expected to be released near the end of November, which could bring volatility to forward power prices along with changing weather forecasts for the approaching winter.