Ohio Energy Report: March 2025

Ohio Senate Passes Senate Bill 2, House Passes House Bill 15

On March 19, 2025, the Ohio Senate passed Amended Substitute Senate Bill 2 (SB 2), which, if enacted, would change many aspects of electric utility service and rates in Ohio. One week later, on March 26, the Ohio House voted on and passed its own companion bill to SB 2 – Substitute House Bill 15 (HB 15).

Both legislative bills aim to encourage new energy generation in Ohio in response to forecasted power supply shortages driven by growing electricity demand from energy-intensive users, particularly large data centers. Since both bills have passed their respective chambers, one will be selected as the vehicle to move to the other chamber, where testimony will likely be taken and potential amendments considered. Once both chambers have voted on and passed a final version of the bill – utilizing a joint conference committee if necessary – it will be sent to the Governor’s desk for signature.

Specific components of both SB 2 and HB 15, as passed by the Senate and House respectively include:

- Elimination of Electric Security Plans (ESP) in Ohio, including ESP riders;

- Elimination of charges to Ohio ratepayers that subsidize the Ohio Valley Electric Corporation coal plants in Ohio and Indiana;

- Elimination of the solar fund in Ohio for solar facilities;

- Preservation of interruptible/transmission programs in rate cases;

- Expedited review of rate and power siting board cases;

- A requirement that utilities file rate cases every three years;

- Permission for mercantile customers to operate behind-the-meter (BTM) power generation stations; and

- A prohibition on utility ownership of generation, except for existing BTM facilities already in operation.

The Ohio Energy Leadership Council (OELC) has been actively engaged in the legislative process for both SB 2 and HB 15. David Proano, Regulatory Counsel for OELC, has testified before both the Senate Energy Committee and the House Energy Committee on multiple occasions.

In his proponent testimonies, Proano has specifically advocated for the continuation of utility interruptible and transmission pilot programs, as well as for reforms to the power siting review process for supplemental transmission projects. Current language in HB 15, if incorporated into SB 2, would require transmission companies to obtain approval from the Ohio Power Siting Board for their 69-kilovolt transmission projects.

Brakey Energy will keep you informed about the outcome of the state legislature’s efforts and the future of SB 2 and HB 15 in upcoming newsletters. If you have any questions about SB 2 or HB 15, please contact Katie Emling.

Transmission Charges Changing for FirstEnergy Customers on April 1, 2025

The Non-Market-Based Services Rider (Rider NMB) rates are set to change on April 1, 2025, for residential and non-residential customers of FirstEnergy’s (FE) three Ohio operating companies: Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE). Rider NMB recovers FE’s non-market-based costs for transmission and ancillary services, with the largest component being PJM’s Network Integration Transmission Service (NITS) charge.

For 2025, the NITS rate in the ATSI Zone – the transmission zone serving FE’s Ohio customers – is expected to increase by only 1% compared to 2024. Despite the NITS rate remaining near current levels, Rider NMB rates for various operating companies and customer classes will either increase or decrease based on each rate class’s share of the summer 2024 peak loads.

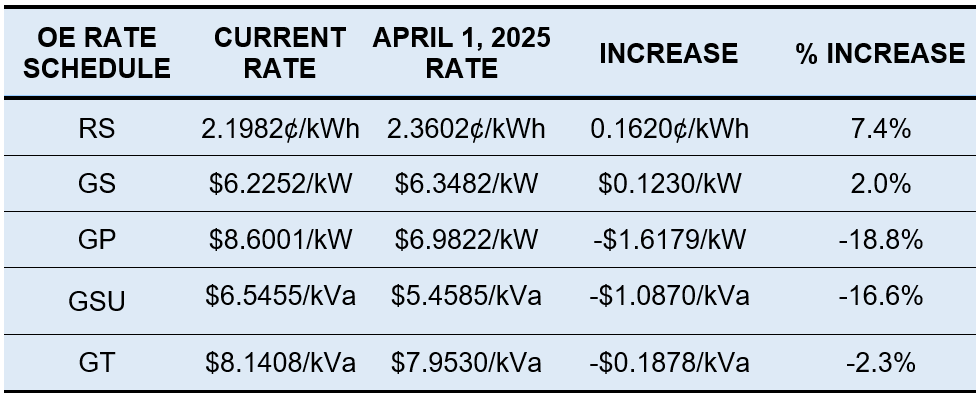

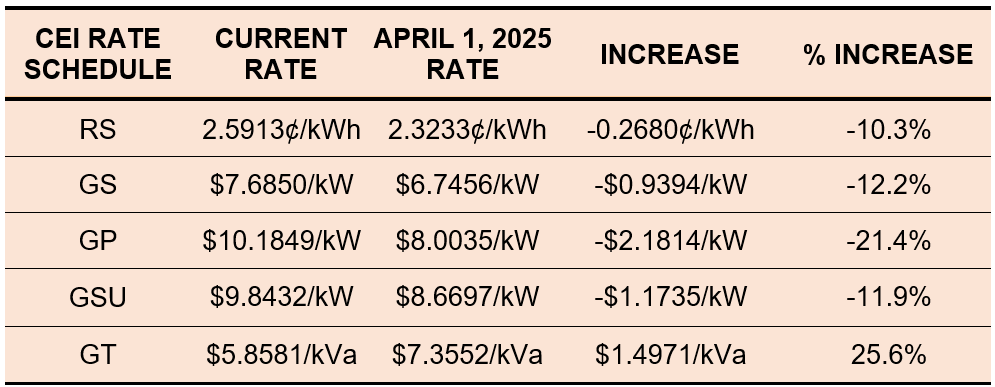

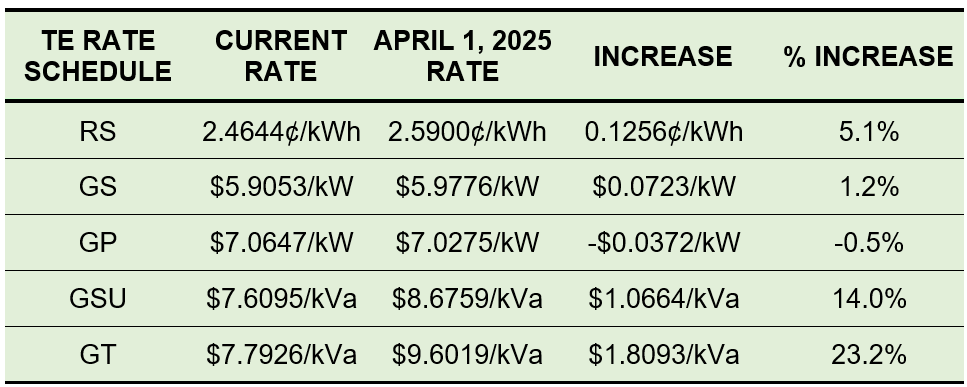

Current and April 1, 2025 Rider NMB rates for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. Rates are per kilowatt-hour (kWh) for RS customers, and per kilowatt (kW) or kilovolt-ampere (kVA) for GS, GP, GSU, and GT customers.

Table 1: OE Rider NMB Rates

Table 2: CEI Rider NMB Rates

Table 3: TE Rider NMB Rates

Clients that are participating in FE’s transmission pilot program are opted out of paying the NMB rider. If you have any questions about this pilot program or how the new NMB rates will impact your electric costs, please contact Katie Emling.

AEP Ohio’s Transmission Rates Changing April 1, 2025

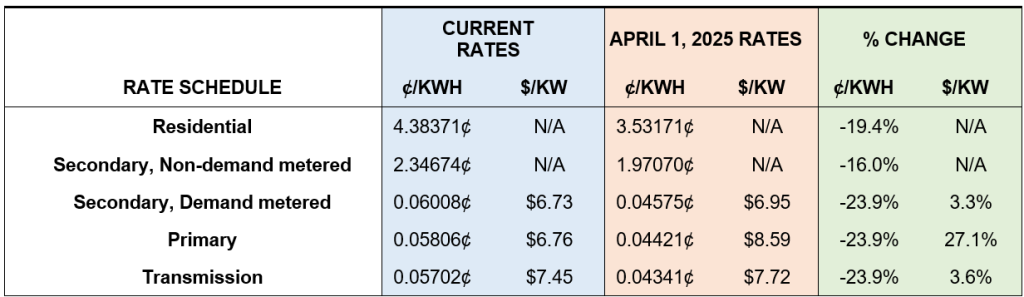

Earlier this month, the PUCO approved rate updates to take effect beginning April 1, 2025 for AEP’s Basic Transmission Cost Rider (BTCR). Based on the final tariff sheets filed, the demand-based billing component of transmission costs for the majority of AEP Ohio non-residential customers will increase by approximately 3% to 27%, depending on the rate schedule. The energy component rate for each non-residential customer class will decrease by approximately 24%. Similarly, residential customers will see a 19% decrease in BTCR charges.

Select interval-metered customers, including Brakey Energy clients, may choose to participate in a transmission pilot program. For participants, the demand portion of BTCR charges is calculated based on the customer’s load during AEP’s 1CP, as opposed to the default method, which uses monthly billed demand.

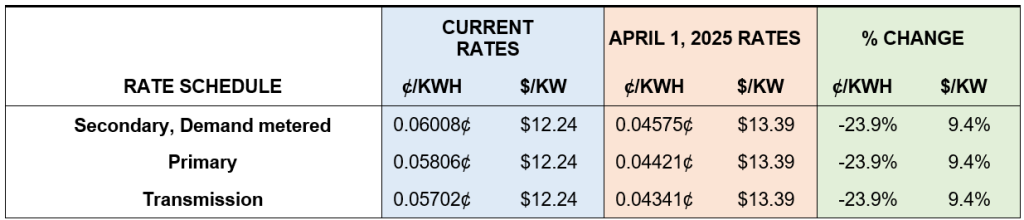

Demand-based BTCR rates for customers participating in AEP’s transmission pilot program will increase by approximately 9%. The tables below show the current and April 1, 2025 BTCR kWh and kW-based rates for non-transmission pilot program customers and transmission pilot program customers of AEP Ohio. The percentage change for each rate is also summarized.

Table 4: Current and April 1, 2025 BTCR Rates for AEP Ohio Customers

Table 5: Current and April 1, 2025 for AEP Ohio Customers Participating in the Transmission Pilot Program

If you would like more information about how the BTCR impacts your monthly electric costs, please contact Katie Emling.

PJM Releases Incremental Auction Results for 2025/2026 Delivery Year

On March 11, 2025, PJM released the results of its third Incremental Auction (IA), finalizing zonal net load capacity prices for the 2025/2026 Delivery Year (DY). Due to delays in the original Base Residual Auction (BRA) schedule, PJM did not hold its first or second IAs for the upcoming DY, which begins on June 1, 2025.

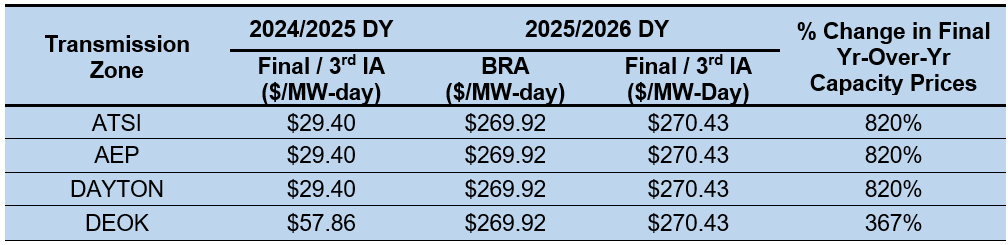

The third IA produced only minimal changes to the final zonal capacity prices compared to the BRA prices for the transmission zones located within Ohio: American Transmission Systems, Incorporated (ATSI), which serves FirstEnergy customers; AEP; Dayton (serving AES Ohio); and Duke Energy Ohio and Kentucky (DEOK). The final zonal net load capacity prices for the 2025/2026 DY increased by $0.51 per MW-day for the ATSI, AEP, Dayton, and DEOK Zones over BRA pricing.

The table below summarizes the final capacity prices for the current 2024/2025 DY, along with the BRA and third IA results for the upcoming DY, by Ohio transmission zone. Customers located in the ATSI, AEP, and Dayton transmission zones that pass through the cost of capacity within an electric supply agreement will see more than a ninefold increase in capacity rates for the 2025/2026 DY. Customers located in the DEOK Zone will see capacity costs increase more than fourfold.

Table 6: PJM BRA Capacity Clearing Prices by DY and Auction

The BRA for the 2026/2027 DY is scheduled to begin July 9, 2025.

We will continue to monitor upcoming PJM BRAs or IAs and report outcomes in future newsletters. If you have any questions about PJM’s wholesale market auctions for capacity, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers extending beyond June 2025 to be materially higher than what customers are accustomed to. Users looking to hide on a low short-term rate can contract with American Power & Gas for three months at an artificially low 4.59¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

The best longer term option is an 8.09¢ 12-month offer from Better Buy Energy. These types of high prices are going to be a shock to residential customers, but there is no getting around this surge in capacity prices.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

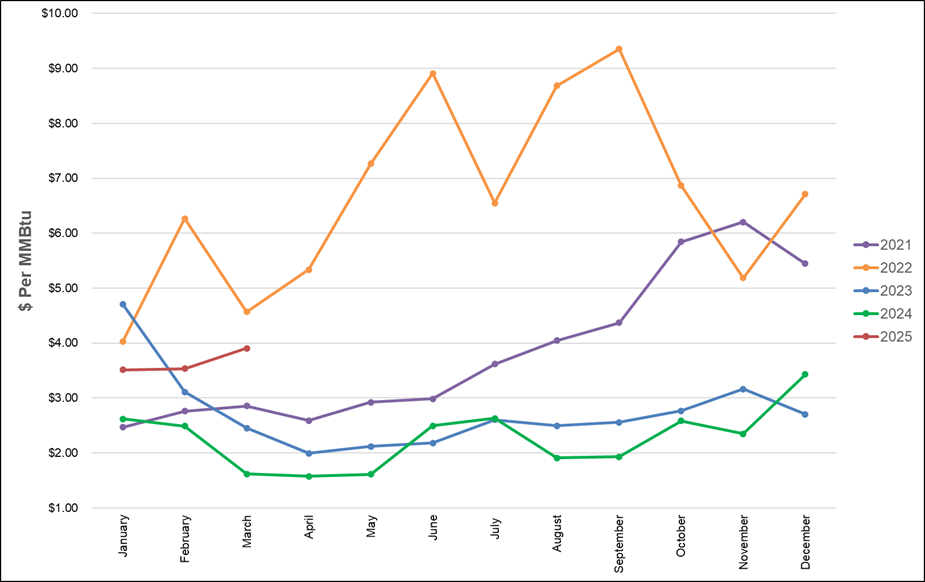

The NYMEX price for March settled at $3.906 per Million British Thermal Units (MMBtu) on February 26, 2025. This price is up 10.5% from the February 2025 price of $3.535 per MMBtu. This settlement price is used to calculate March gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year to date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

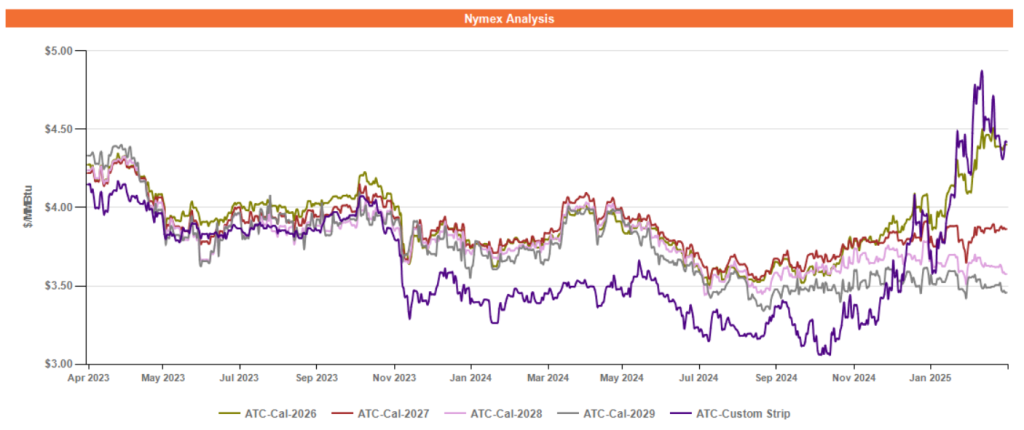

Figure 2 below shows the historical March 31, 2023 through March 31, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Over the past month, forward natural gas prices have remained steady and are still trading near their five-year highs for the balance of 2025 and through 2026. The pronounced state of backwardation also remains, where outlier years 2027 and beyond are trading well below the shorter term through 2026.

The United States’ liquefied natural gas (LNG) export capacity will continue to grow this year, driven primarily by the expanding Plaquemines and Corpus Christi export hubs. Producers have been tepid to announce production increase forecasts, and market participants currently expect output to remain steady or increase only slightly. Steady production combined with gas storage levels 24% below last year and 7% below the five-year average for this time of year have market participants assessing how summer weather and increased LNG exports could affect the ability to refill storage before next winter, and this has buoyed forward prices through 2026.

In outlier years, price action reflects market participants’ anticipation of a possible global glut in LNG availability, which would leave more gas available domestically, depressing forward gas prices. The United States is not alone in increasing its export capacity; Canada, Mexico, Qatar, and Australia all continue to increase their export capacity as well.

Electricity Market Update

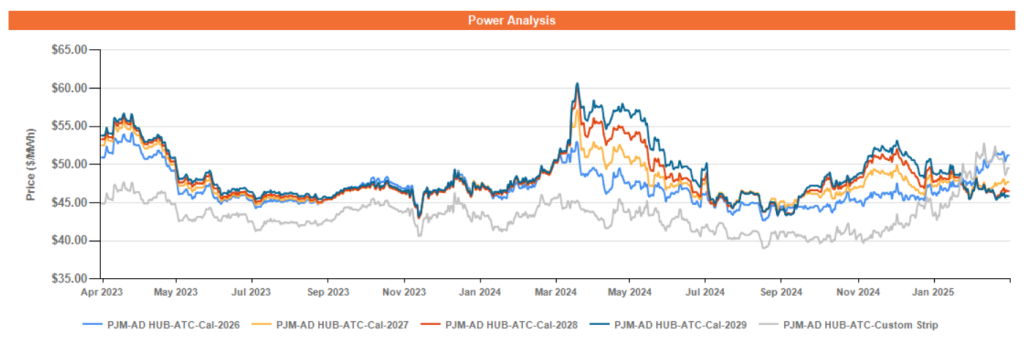

Figure 3 below shows the historical March 31, 2023 – March 31, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Price action in the forward power market over the past month has correlated strongly with the forward gas market, where prices remain relatively high, but stable, for the balance of 2025 through 2026. Outlier years 2027 and beyond are trading at a discount to the shorter term, preserving the state of backwardation in the market.

Summer 2025 is now setting new five-year highs, while calendar year 2026 is trading near its five-year highs. Despite mild to average temperatures over the past two summers, power burn demand for gas set records in both years – 2023 set a then-record high, which was surpassed in 2024. Market participants are weighing the possibility that summer 2025 power burn demand could be just as high or higher, against natural gas prices already at five-year highs. As a result, forward power prices for this summer have surged.

Forward power prices in outlier years 2027 and beyond have also been strongly correlated with the forward gas market. Prices have softened in part due to market participants’ anticipation of a potential global LNG glut that could increase gas availability domestically, even though there is widespread anticipation of significant power demand growth through at least 2029.