Ohio Energy Report: March 2024

Carolyn’s Campaign

We are excited to announce that Carolyn Brakey is the Republican nominee for Geauga County Commissioner! Carolyn secured a 14-point victory Tuesday night. Carolyn now advances to November where she will face a Democrat challenger.

Thank you for the incredible and ongoing support from so many of our clients and colleagues. Please feel free to reach out to Carolyn to offer your own congratulations.

Transmission Costs Expected to Increase for AES Ohio Customers Beginning in June

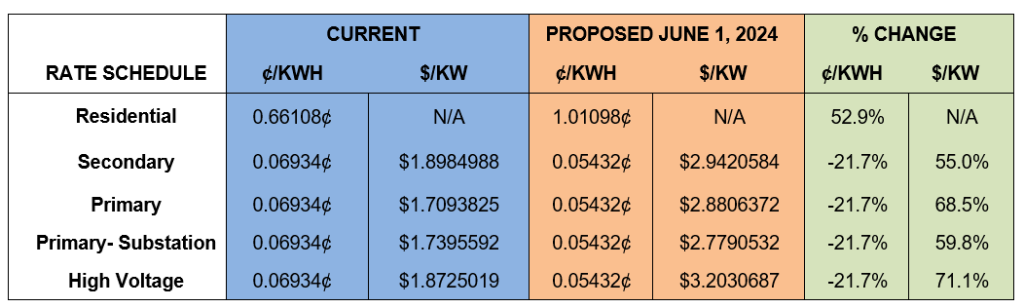

On March 15, 2024, AES Ohio filed proposed rate changes to its Transmission Cost Recovery Rider (TCRR) rates, which recover transmission-related costs imposed on or charged to AES Ohio by the Federal Energy Regulatory Commission or PJM Interconnection (PJM). Residential customers are exclusively billed on a kWh basis whereas non-residential customers have both a kWh and kW billing component.

The proposed increases in transmission charges for AES Ohio customers come in response to a 75% in PJM’s projected annual Network Integration Transmission Service (NITS) rate for the Dayton Zone, which is the transmission zone serving AES Ohio. NITS charges are the largest component of the transmission costs that AES Ohio recovers from its customers. The increase in annual transmission costs are the result of the continued growth in AES Ohio’s transmission investments.

The table below shows the current and proposed June 1, 2024 TCRR rates for customers of AES Ohio.

Table 1: Current and Proposed June 1, 2024 TCRR Rates for AES Ohio

Customers that are participating in AES Ohio’s transmission pilot program are opted out of paying the TCRR rider. If you have any questions about this pilot program or how the new TCRR rates will impact your electric costs, please contact Katie Emling.

PJM Releases Incremental Auction Results for 2024/2025 Delivery Year

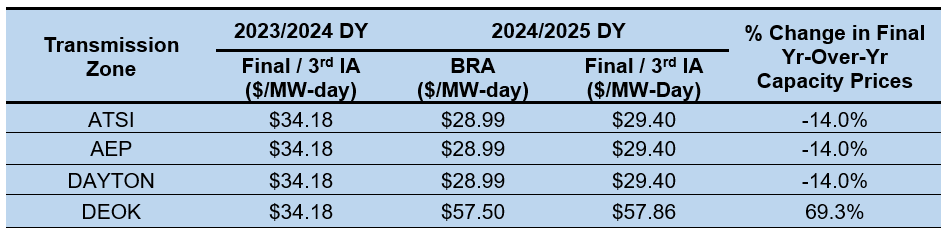

On March 11, 2024, PJM released the results of its third Incremental Auction (IA) for final zonal net load capacity prices for the 2024/2025 Delivery Year (DY). Due to delays in the original Base Residual Auction (BRA) schedule, PJM did not hold its first or second IAs for the upcoming DY beginning June 1, 2024.

The third IA produced very minimal changes to the final zonal capacity prices compared to the BRA prices for the transmission zones located within Ohio: American Transmission Systems, Incorporated, or ATSI (serving FE customers), AEP, Dayton (serving AES-Ohio), and Duke Energy Ohio and Kentucky (DEOK). The final zonal net load capacity prices for the 2024/2025 DY increased by $0.41 per MW-day for the ATSI, AEP, and Dayton Zones. Final capacity prices for the DEOK Zone increased by only $0.36 per MW-day.

The table below summarizes the final capacity prices for the current 2023/2024 DY along with the BRA and third IA results for the upcoming DY by Ohio transmission zone. Customers located in the ATSI, AEP, or Dayton transmission zones that pass through the cost of capacity within an electric supply agreement will see a 14% decrease in their capacity rates. Customers in Duke’s service territory who pass through the cost of capacity will see a 69.3% increase in their capacity rates for the 2024/2025 DY.

Table 2: PJM BRA Capacity Clearing Prices by DY and Auction

The BRA for the 2025/2026 DY is scheduled to begin July 17, 2024.

We will continue to monitor upcoming PJM BRAs or IAs and report outcomes in future newsletters. If you have any questions about PJM’s wholesale market auctions for capacity, please contact Katie Emling.

Residential Corner

The best offer we are currently seeing is from Better Buy Energy for eight months at a rate of 5.35¢/kWh. Although relatively inexpensive to other offers, Better Buy Energy is carving out expensive Winter 2025 months by not making it a full year offer.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

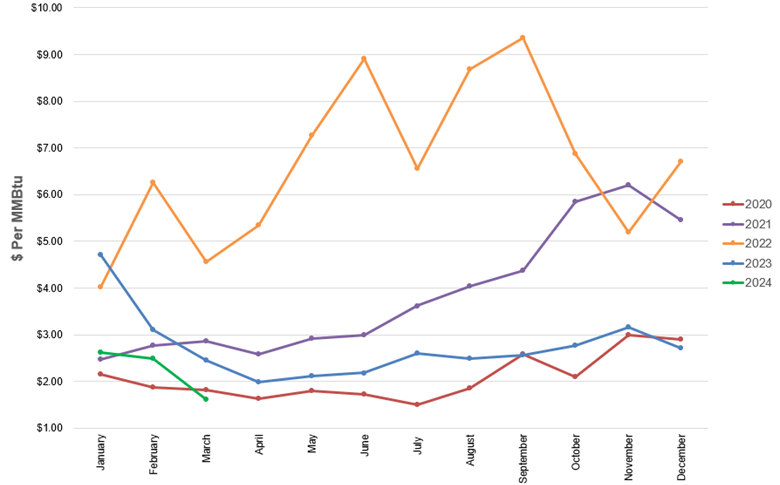

The NYMEX price for March settled at $1.615 per Million British Thermal Units (MMBtu) on February 27, 2024. This price is down 35.1% from the February 2024 price of $2.490 per MMBtu. March’s settlement price is the lowest price NYMEX has settled at since July 2020. This settlement price is used to calculate March gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

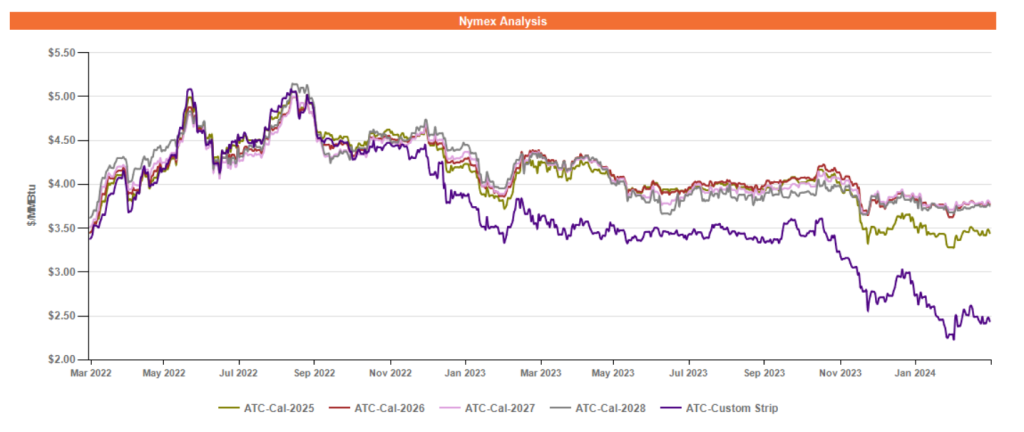

Figure 2 below shows the historical March 22, 2022 through March 22, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

The mild winter has produced a relative natural gas storage glut, similar to the winter of 2022/2023. As of the week ending March 8, underground natural gas storage levels are 17% above last year and 37% above the 5-year average. Forward NYMEX natural gas prices are trading at a relative discount to historical levels through 2024 and well into 2025 as a result of this storage glut.

Electricity Market Update

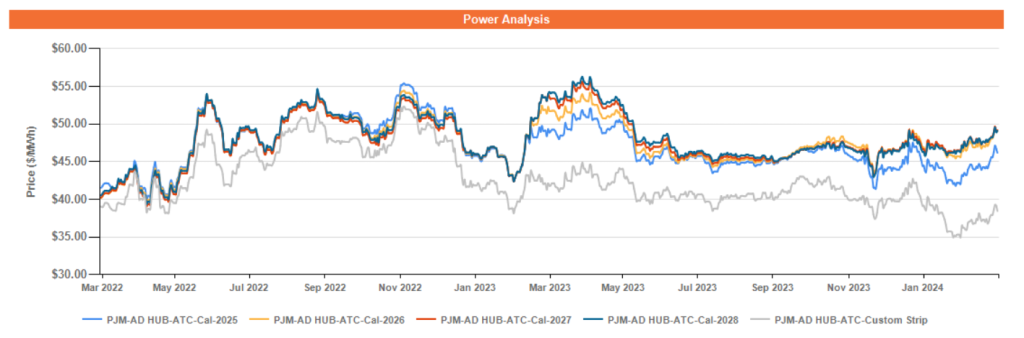

Figure 3 below shows the historical March 22, 2022 – March 22, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.

The forward power market has seen some decoupling from the forward gas market recently. Typically, forward power and gas prices are highly correlated, due to natural gas fueling approximately 40% of power generation nationwide. Over the past week, forward power prices have reacted to meteorologists shifting their forecasts for when the current El Niño event will end and when the upcoming La Niña event will succeed it.

Until recently, meteorologists were forecasting a start to the La Niña in the late summer or early fall, whereas they are now forecasting the La Niña to start in early summer, with an approximate 70% probability. Generally, La Niña events correspond with warm and muggy summers and cool and wet winters in the central and eastern US. The previous La Niña event occurred from Winter 2020 to Summer 2023.