Ohio Energy Report: June 2024

FirstEnergy Files 2024 Base Distribution Rate Case

On May 31, 2024, the FirstEnergy (FE) companies of Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE) filed a new base distribution rate case with the Public Utilities Commission of Ohio (PUCO). This is FE’s first distribution rate case since 2007; its base distribution tariffs have not been updated since 2009.

As stated in the application, FE is proposing to increase its distribution rates, make changes to some tariffs and accounting methods, recover approved cost deferrals, adopt new charges, and approve new customer programs. Overall, the Companies are requesting net changes in revenue of $25 million for OE (a net increase of 3.4%), $76 million for CEI (a net increase of 13.3%), and -$7 million for TE (a net decrease of 3.3%).

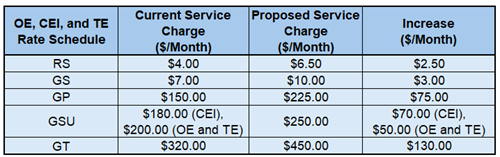

Table 1 below summarizes the current and proposed monthly service charges for OE, CEI, and TE Residential (RS), General Service Secondary (GS), General Service Primary (GP), General Service Subtransmission (GSU), and General Service Transmission (GT) customers.

Table 1: FE Current and Proposed Customer Service Charges by Rate Schedule

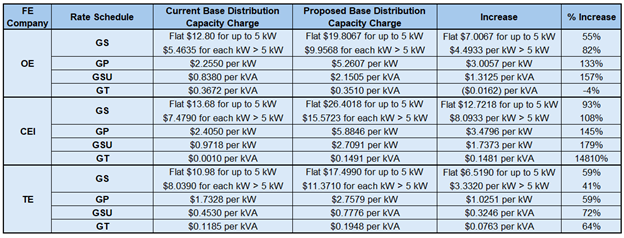

Table 2: FE Current and Proposed Base Distribution Capacity Charges by Rate Schedule

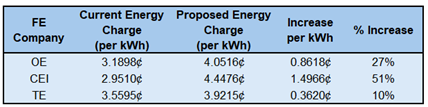

Table 3: FE Current and Proposed Base Distribution Energy Charges for RS Customers

In addition to the proposed changes to the monthly customer service charge and the base distribution capacity and energy rates, FE has proposed to increase the reactive demand charges for applicable rate schedules from $0.36 per billed reactive demand (rkVA) to $0.60 per rkVA.

If you have any questions about how FE’s proposals filed in their base distribution rate case will impact your electric costs, please contact Katie Emling.

FirstEnergy Files Application for Rehearing in ESP V Case

On June 14, FE filed an Application for Rehearing of the Public Utilities Commission of Ohio’s (PUCO) May 15, 2024 Opinion and Order in FE’s Fifth Electric Security Plan (ESP V) case.

In its Application, FE contends that the PUCO’s decision was unlawful or unreasonable because of (1) the PUCO’s decision to defer the resolution of material issues in the ESP V case to its 2024 Base Distribution Rate Case, (2) the PUCO’s limited approval of its existing Delivery Capital Recovery Rider (Rider DCR), new Vegetation Management Cost Recovery Rider, and new Storm Cost Recovery Rider during the period between the effective date of ESP V and the date on which new base rates go into effect (known as the “Bridge Period”), and (3) the PUCO’s approval to limit recovery of costs under Rider DCR to certain investments during the Bridge Period.

In response, Ohio Energy Leadership Council (OELC) submitted a Memorandum Contra to FE’s Application. Brakey Energy represents its clients’ interests in OELC.

Other interested parties that intervened in the ESP V case and submitted their own Applications for Rehearing include: the Northwest Ohio Aggregation Coalition, the Office of the Ohio Consumers’ Counsel, One Energy Enterprises Inc., the Ohio Manufacturers’ Association Energy Group, the Environmental Law and Policy Center, the Citizens Utility Board of Ohio, and the Ohio Environmental Council.

The PUCO Commissioners must issue an “entry” for rehearing within 30 days of the submission of those applications for rehearing or the application for rehearing is automatically denied. The Commission may: (1) deny rehearing, (2) grant rehearing and modify the opinion and order, or (3) grant rehearing and hold additional hearings then issue an “order on rehearing.” Once the rehearing process is complete at the PUCO, parties may appeal the Commission decision to the Supreme Court of Ohio.

Peak Loads for Summer 2024

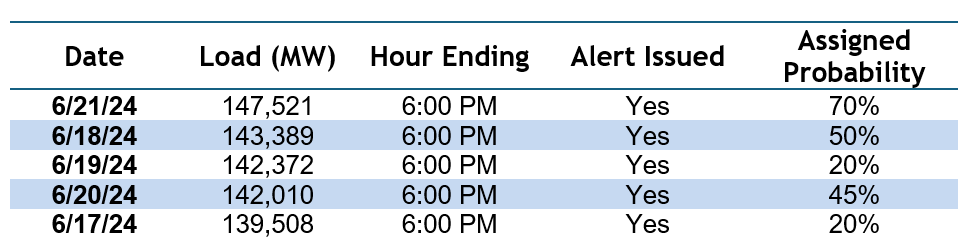

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to those clients that elect to receive them. In response to the heat dome that hovered over most of the PJM footprint during the week of June 17-22, Brakey Energy issued five Capacity CP alerts, six FE (ATSI Zone) Transmission CP alerts, and five AEP Ohio CP alerts for this CP management year. Brakey Energy also issued three winter alerts for the AEP Zone back in January.

Capacity CPs occur during the five one-hour intervals when demand on the PJM grid is at its highest. Transmission CPs for FE customers occur during the five one-hour intervals when demand on FE’s zonal grid is at its highest. The Transmission CP for AEP customers occurs during the one-hour interval when demand on AEP’s zonal grid is at its highest.

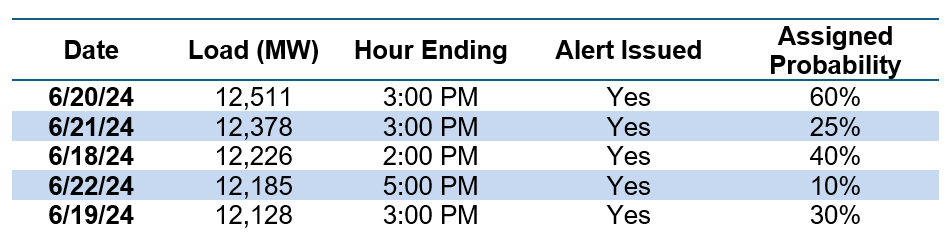

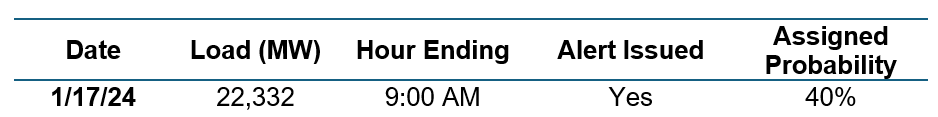

The tables below list PJM’s and FE’s five highest loads and AEP’s single highest load this year, as well as the day and time of each occurrence. This is based on preliminary data.

Table 4: Five Highest Loads for PJM through June 26, 2024

Table 5: Five Highest Loads for FE through June 26, 2024

Table 6: Single Highest Load for AEP through June 26, 2024

In our 2024 Coincident Peak Forecasting Report, we forecasted that the 1CP and 5CP for PJM will be 147,216 Megawatt (MW) and 138,860 MW, respectively, and that the 1CP and 5CP for FE would register at 12,448 MW and 11,928 MW, respectively. PJM’s and ATSI’s top five peak loads to date have fallen within or above those respective ranges. However, the summer is just getting underway and it remains unclear how many of these CPs will remain in the top five come summer end. The National Weather Service is predicting that above average temperatures for the ATSI and AEP Zones as well as the RTO as a whole will continue into mid-July.

In our 2024 Coincident Peak Forecasting Report, we discussed the strong likelihood that the load during the hour ending (HE) 9:00 AM on January 17, 2024 may end up setting the 1CP for the AEP Zone between November 1, 2023 and October 31, 2024. Load forecasts in the AEP Zone for the week of June 17 had the potential to challenge that peak, but ultimately metered loads fell short of surpassing it. AEP’s highest preliminary metered peak load during the week of June 17 occurred during the HE 3:00 PM on June 17 with a load of 21,625 MW. This load is 707 MW below AEP’s highest peak load to date.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted. If you are a Brakey Energy client that has not signed up for these alerts but would like to, please email Catherine Nickoson.

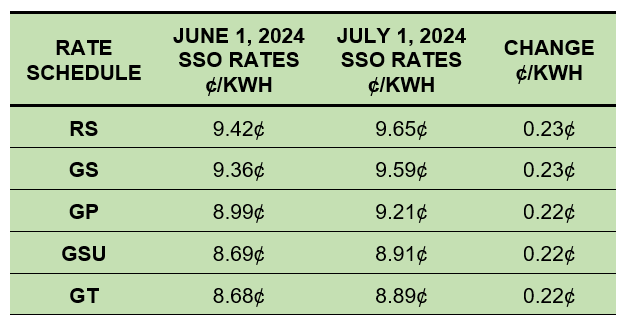

FE Announces Updates to SSO Rates

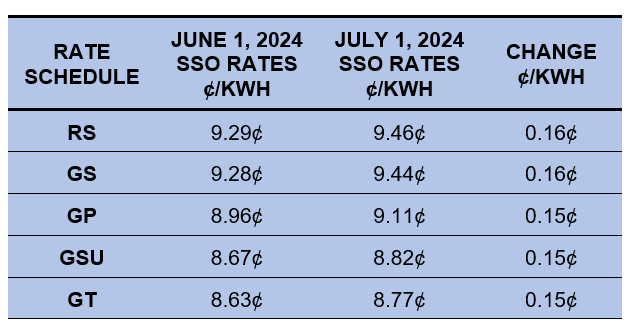

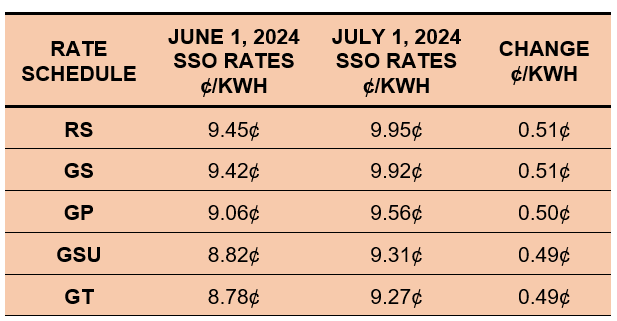

Electric costs will be increasing on July 1 for FE customers that take electric generation service under OE’s, CEI’s, and TE’s Standard Service Offer (SSO). The SSO is the default rate charged by the utility for generation services to customers that do not contract with an alternative supplier. FE’s SSO generation rates are higher in the three summer months of June, July, and August than they are in the other nine months of the year.

The tables below compare the current and July 1 SSO rates per kWh for OE, CEI, and TE RS, GS, GP, GSU, and GT rate schedules. These rates will change again on September 1.

Table 7: OE SSO Rates

Table 8: CEI SSO Rates

Table 9: TE SSO Rates

SSO rates are lower than they were one year ago, but they still remain enough above market that virtually all customers should be competitively sourcing power. If you would like more information about how FE’s recent SSO rate updates will impact your monthly electric costs, please contact Katie Emling.

Residential Corner

Residential power supply offers are less attractive than they’ve been in recent months. With his own residential contract approaching expiration, Matt Brakey just contracted with American Power & Gas for a 3-month price of 4.59¢. He plans to ride out the more expensive summer on this teaser rate and enter into a longer term agreement in late September. We believe this is the most attractive option for customers at this time.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

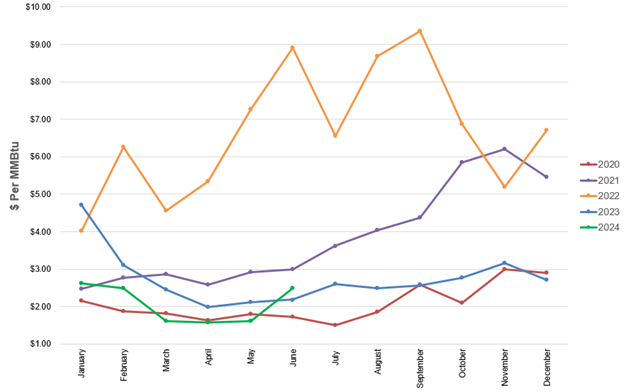

Natural Gas Market Update

The NYMEX price for June settled at $2.493 per Million British Thermal Units (MMBtu) on May 29, 2024. This price is up 54% from the May 2024 price of $1.614 per MMBtu. This settlement price is used to calculate June gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

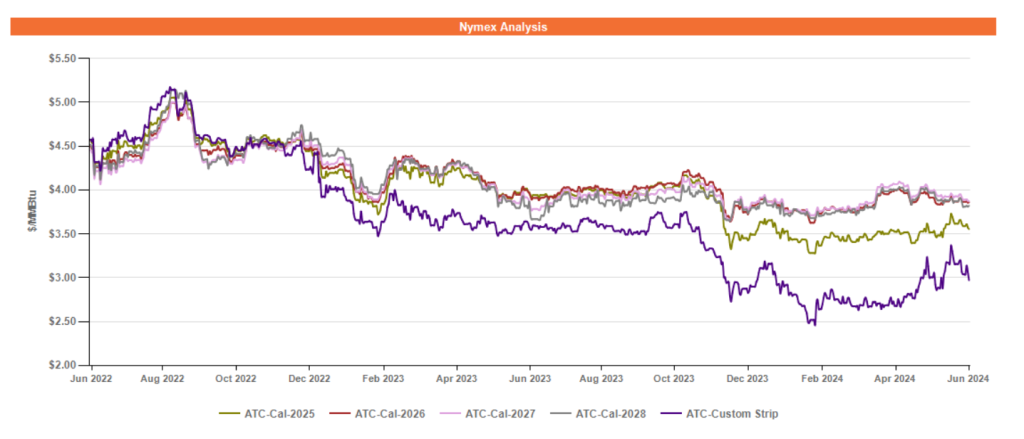

Figure 2 below shows the historical June 27, 2022 through June 27, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Natural gas forward prices have been on the rise since early May, thanks to increased weather demand from what is expected to be confirmed as the hottest June since 1950 in the US. Amidst this hot weather and forecasts predicting it to continue, forward gas prices have rebounded enough for some producers to lift their previously imposed production cuts from March. This has somewhat tempered the recent rally in natural gas prices. Market participants will be keenly watching gas production numbers and temperature forecasts as the summer continues.

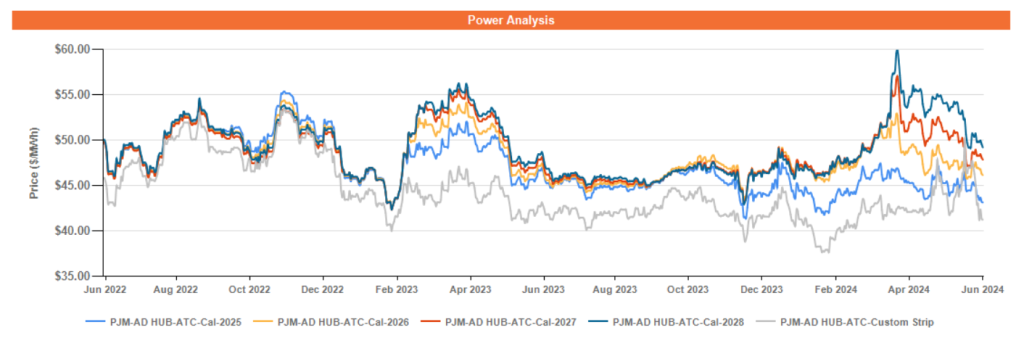

Electricity Market Update

Figure 3 below shows the historical June 27, 2022 through June 27, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Forward electricity prices continue to be volatile in all parts of the curve, including outlier years that are not as sensitive to short-term weather outlooks. Forward prices for the balance of 2024 and Calendar Year (CY) 2025 have been sensitive to transient weather outlooks for the remainder of the summer, but rebounding natural gas production could help temper volatility. Since the sharp price increase in late March, outlier years have softened, but remain trading in a state of pronounced contango.