Ohio Energy Report: July 2024

Utilities Respond to Expected Data Center Load Growth

On May 13, 2024, AEP Ohio filed an Application for Approval of New Tariffs with the Public Utilities Commission of Ohio which seeks to establish two new customer classifications: (1) the Data Center Power tariff for demands greater than 25 Megawatts (MW) and (2) the Mobile Data Center/Flexible Load Tariff for demands greater than 1 MW.

The proposed tariffs include terms that are unattractive to data centers, including: high minimum billing demand requirements, minimum contract terms of 10 years, and to-be-determined security and collateral provisions (i.e., exit fees and/or deposits) to support enforcement of the tariffs. In its filing, AEP Ohio indicates that it feels these tariffs are necessary to ensure that other AEP Ohio customers are not left to foot the bill for expensive, long-term transmission build outs should a data center abandon its plans or financial obligations. The Ohio Energy Leadership Council (OELC) filed initial and reply comments critiquing AEP’s filing.

While this may be the first such filing by an electric distribution utility (EDU) in Ohio, we may see other EDUs follow suit with similar applications depending on the case outcome. This is because load growth from data centers and cryptocurrency mining is currently projected to grow substantially in not just AEP Ohio’s service territory, but FirstEnergy’s (FE) territory as well. According to a recent article in Crain’s Cleveland Business, FE was asked to complete a total of 58 load studies in 2023 and the first half of 2024. Each study was based on capacity demands of 500 MW or more.

As Matt Brakey was quoted saying in the article, with such significant increases in demand on the grid, “There would certainly be upward pressure on power prices, and notable ones at that.” He expects that the increase in demand would specifically result in higher transmission costs as a result of the significant investments in transmission infrastructure necessary to accommodate the load growth.

Peak Loads for Summer 2024

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to those clients that elect to receive them. As of July 26, 2024, Brakey Energy has issued 10 Capacity CP alerts, seven FE (ATSI Zone) Transmission CP alerts, and seven AEP Ohio CP alerts during Summer 2024. Brakey Energy also issued three winter alerts for the AEP Zone in January of this year.

Capacity CPs occur during the five one-hour intervals when demand on the PJM grid is at its highest. Transmission CPs for FE customers occur during the five one-hour intervals when demand on FE’s zonal grid is at its highest. The Transmission CP for AEP customers occurs during the one-hour interval when demand on AEP’s zonal grid is at its highest.

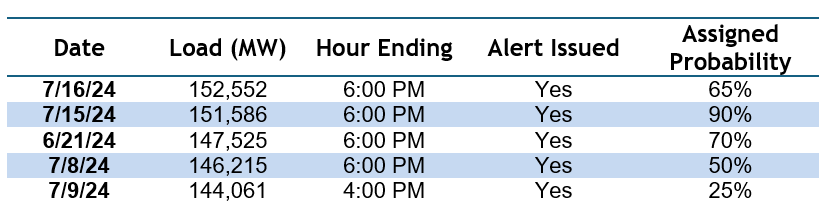

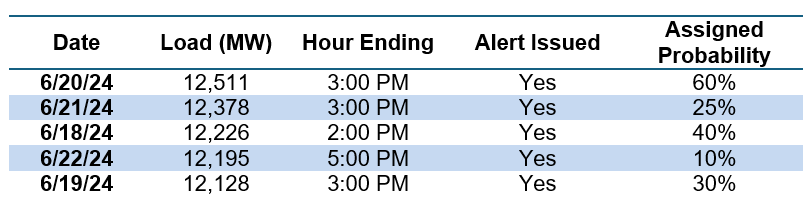

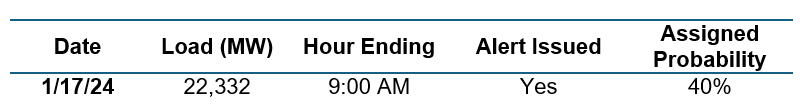

The tables below list PJM’s and FE’s five highest loads and AEP’s single highest load this year, as well as the day and time of each occurrence. This is based on preliminary data.

Table 1: Five Highest Loads for PJM through July 25, 2024

Table 2: Five Highest Loads for FE through July 25, 2024

Table 3: Single Highest Load for AEP through July 25, 2024

In our 2024 Coincident Peak Forecasting Report, we forecasted that the 1CP and 5CP for PJM will be 147,216 Megawatt (MW) and 138,860 MW, respectively, and that the 1CP and 5CP for FE would register at 12,448 MW and 11,928 MW, respectively. PJM’s and ATSI’s top five peak loads to date have fallen within or above those respective ranges. The summer CP season ends on September 30, which is still more than two months away, however we believe there is a strong probability that many of the PJM and ATSI loads listed in the tables above will be CPs at the end of summer.

In our 2024 Coincident Peak Forecasting Report, we discussed the strong likelihood that the load during the HE 9:00 AM on January 17, 2024 may end up setting the 1CP for the AEP Zone between November 1, 2023 and October 31, 2024.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted. If you are a Brakey Energy client that has not signed up for these alerts but would like to, please email Catherine Nickoson.

Carolyn’s Campaign

Carolyn Brakey is Geauga’s Republican nominee for County Commissioner, and her campaign is again gaining momentum as we head into the November general election. In her most recent campaign newsletter, Carolyn shares a few personal anecdotes of some of her meetings with Republican Vice President nominee J.D. Vance.

One anecdote Carolyn didn’t share in her newsletter is from a meeting Burton, Ohio. In the below photo, published on J.D. Vance’s Facebook page on October 13, 2021, you can see Carolyn intently speaking to the then U.S. Senate candidate. The topic of their conversation? The intricacies of power markets, of course. (True story.)

Residential Corner

Despite recent softness in natural gas and power markets, there are no jump-off-the-page offers available at the moment. If you are in a pinch and have a contract approaching expiration, we recommend a 12-month offer from Energy Harbor for 5.99¢. Hopefully better offers will present themselves as we move through the summer.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

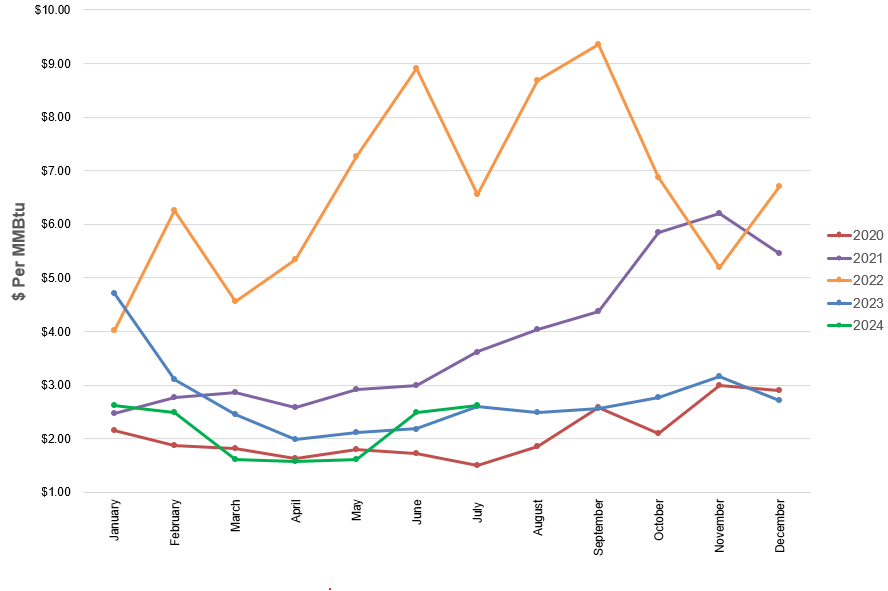

The NYMEX price for July settled at $2.628 per Million British Thermal Units (MMBtu) on June 26, 2024. This price is up 5.4% from the June 2024 price of $2.493 per MMBtu. This settlement price is used to calculate July gas supply costs for customers that contract for a NYMEX-based index gas product. In comparison to last summer, the NYMEX pricing for July 2024 is less than 1% higher than where NYMEX prices settled for July 2023.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

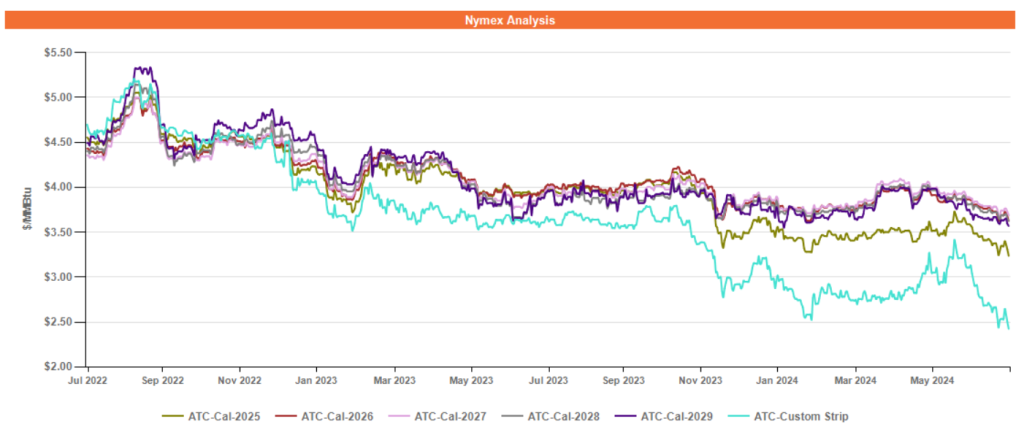

Figure 2 below shows the historical July 26, 2022 through July 26, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices have softened over the last month as gas production has rebounded back to 102 BCF/d, and Hurricane Beryl restricted LNG exports from the gulf. Temperature forecasts are calling for widespread excessive heat over much of the US into early August, but the uptrend in gas production may help stifle volatility in forward prices.

Electricity Market Update

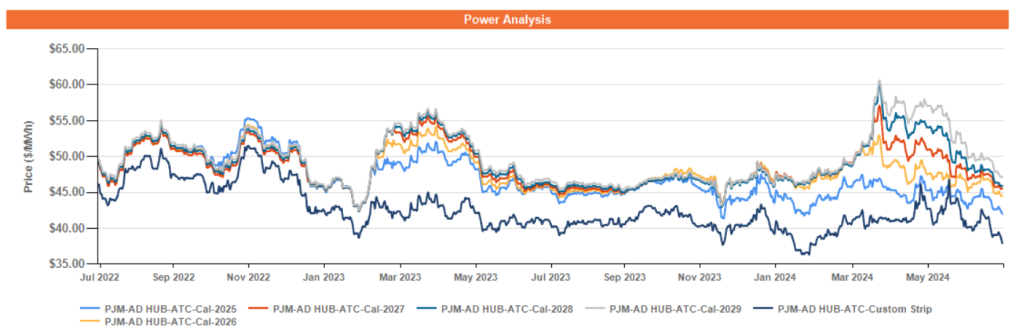

Figure 3 below shows the historical July 26, 2022 through July 26, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Forward power prices in 2024 and 2025 have continued the trend of volatile price action in response to transient temperature forecasts. Much of the country has experienced normal temperatures since the heat waves in mid-June and early July, but temperature forecasts are calling for widespread excessive heat to return in early August.

Outlier years have mostly traded sideways over the past month in anticipation of the results of PJM’s capacity auction on July 30, which could offer market participants insight into the generation fuel-mix in 2025 and beyond.