Ohio Energy Report: July 2023

Carolyn Brakey to Hold First Fundraiser for County Commissioner Bid

Carolyn Brakey, General Counsel to Brakey Energy, is running for Geauga County Commissioner. She currently serves as President of the Geauga County Board of Health. She counts among her Board accomplishments ending mask mandates in Geauga County schools, making the department more efficient, and cutting intrusive regulations.

Carolyn’s first fundraising event will be July 27 at the Wembley Club in Bainbridge Township. While there will be something for everyone, the event will particularly be a special treat for pickleball players.

Carolyn would be honored to have your support. Please email Carolyn for more information on the event or her campaign. We hope to see you there!

Peak Loads for Summer 2023

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to those clients that elect to receive them. As of July 18, 2023, Brakey Energy has issued one Capacity CP alert and one FirstEnergy-Ohio (FE) Transmission CP alert. We have not issued any AEP Ohio CP alerts during Summer 2023. To-date, forecasted and registered load have remained below our predictive CP range for the summer.

Capacity CPs occur during the five one-hour intervals when demand on the PJM grid is at its highest. Transmission CPs for FE customers occur during the five one-hour intervals when demand on FE’s zonal grid is at its highest. The Transmission CP for AEP customers occurs during the one-hour interval when demand on AEP’s zonal grid is at its highest.

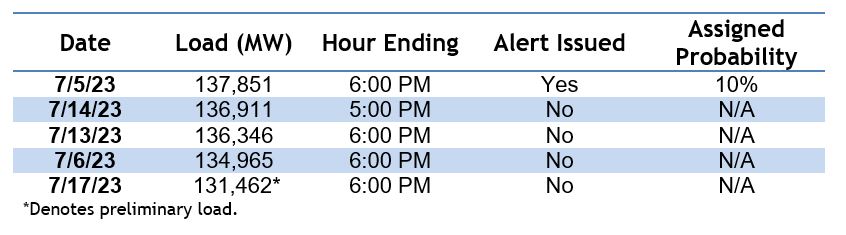

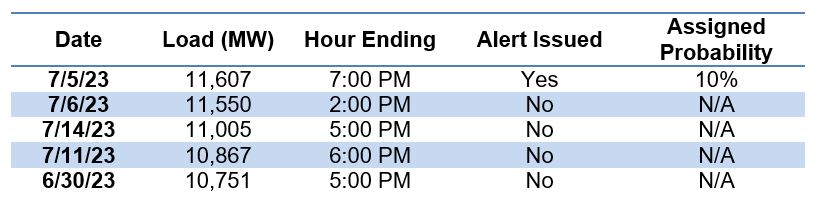

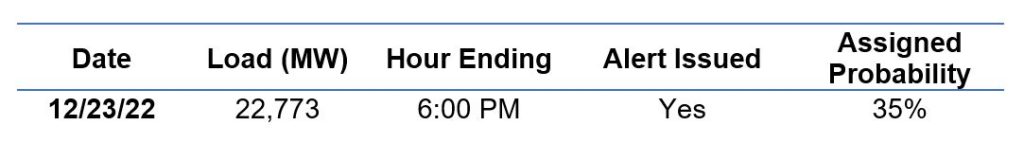

The tables below list PJM’s and FE’s five highest 2023 summer loads and AEP’s single highest load since November 1, 2022, as well as the day and time of each occurrence. This is based on preliminary data.

Table 1: Five Highest Summer Loads for PJM through July 17, 2023

Table 2: Five Highest Summer Loads for FE through July 17, 2023

Table 3: Single Highest Load for AEP through July 16, 2023

In our 2023 Coincident Peak Forecasting Report, we forecasted that the 1CP and 5CP for PJM will be 147,433 MW and 142,541 MW, respectively, and that the 1CP and 5CP for FE would register at 12,656 MW and 12,149 MW, respectively. PJM and FE’s top five peak loads to date have fallen notably below this range. With half of July and all of August and September yet to come, we expect that all of the loads shown in Tables 1 and 2 will be displaced.

In our 2023 Coincident Peak Forecasting Report, we discussed the strong likelihood that the load during the HE 6:00 PM on December 23, 2022 may end up setting the 1CP for the AEP Zone between November 1, 2022 and October 31, 2023.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted. If you are a Brakey Energy client that has not signed up for these alerts but would like to, please email Catherine Nickoson.

Residential Corner

Clean Choice Energy is offering a shockingly low 4.3¢/kWh 100% renewable 12-month agreement. Quite frankly, we’re scratching our heads because this offer is significantly lower than everything else on the market – especially given the renewable content.

Fair warning: If this proves to be too good to be true, there is always the risk that you will get dumped back onto the very high Standard Service Offer rate in the event the supplier defaults. However, for this competitive a rate, it is understandable why many would choose to accept the risk.

Regarding natural gas, if you entered into a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted prior to this past winter, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market – especially through the fall. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

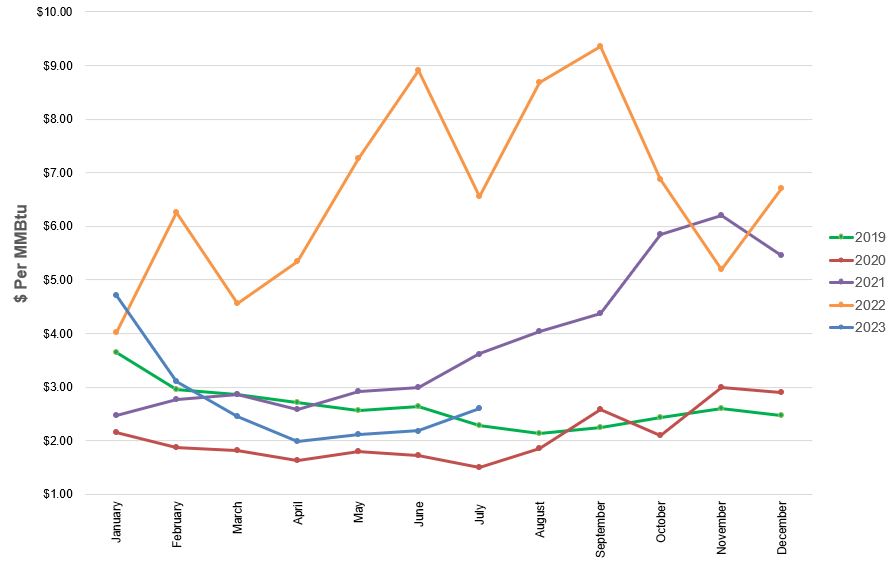

The NYMEX price for July settled at $2.603 per Million British Thermal Units (MMBtu) on June 28, 2023. This price is up 19.3% from June’s price of $2.181 per MMBtu. This settlement price is used to calculate July gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2019, 2020, 2021, 2022, and 2023 to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

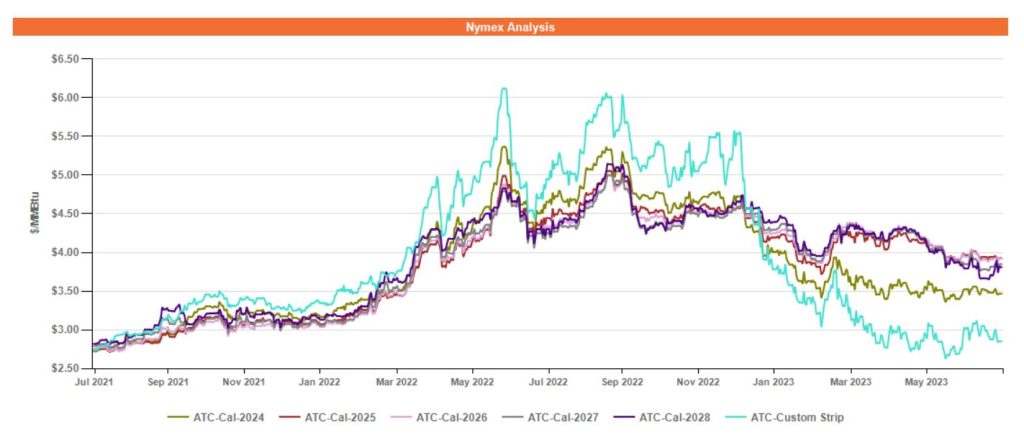

Figure 2 below shows the historical July 18, 2021 through July 18, 2023 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028. Natural gas prices for the balance of 2023 and calendar year 2024 continue to trade at lower levels compared to outlier years, reflecting a state of contango in the market. Prices for outlier years have softened in recent weeks after experiencing an increase earlier this spring.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Electricity Market Update

Figure 3 below shows the historical July 18, 2021 through July 18, 2023 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028 for the AD Hub. Like gas, the power market finds itself in a state of contango. Although there was some daylight between forward prices for calendar years 2025 through 2028 earlier this year, the figure below illustrates that current prices for those outlier years are trading at approximately the same prices. After a slight run up in prices this past spring, prices for outlier years have also returned to levels they were trading at in early 2023.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

Pricing courtesy of Direct Energy Business.