Ohio Energy Report: February 2024

Make Plans to Attend the Upcoming Ohio Energy Management Conference

The Brakey team will have a strong presence at this month’s Ohio Energy Management Conference and will be leading several workshops. The conference is Ohio’s premier conference on energy rates, regulations, and efficiency. It will take place February 27-28 at the Columbus Renaissance Hotel. Brakey Energy and the Ohio Energy Leadership Counsel are proud sponsors of the Ohio Energy Management Conference.

This year, we are excited to announce that Brakey Energy clients can receive complimentary registration to the conference. Please contact Catherine Nickoson if you are interested in attending one or both days.

To see a complete agenda and to register online, please visit the event website.

FERC Approves PJM Capacity Market Reforms

On January 30, 2024, the Federal Energy Regulatory Commission (FERC) issued an Order approving one of PJM Interconnection’s (PJM) two proposals related to capacity market reforms that it filed with FERC in October 2023. In the Order, FERC Commissioners stated that, “PJM’s proposal will allow its markets to better value the ability of individual resources to address tight system conditions and emergencies, as well as resource adequacy challenges associated with correlated resource outages and an evolving resource mix.”

As summarized in the order, PJM expects that using its approved market reforms, consumers will only be impacted modestly. To illustrate potential cost impacts, PJM used its proposed reforms associated with risk modeling and Effective Load Carrying Capability in simulations used to re-run the 2024/2025 Base Residual Auction (BRA). The results of those simulations indicated total costs to consumers “increased from $2.2 billion in the status quo case to $2.4 billion in the enhanced design case.”

Although FERC rejected the second of PJM’s capacity market reform filings, FERC’s approval of PJM’s first proposal will enable PJM to proceed with the BRA for the 2024/2025 Delivery Year (DY) this summer. PJM is requesting FERC’s approval to schedule that BRA for July 2024. Historically, BRAs were intended to take place in May three years prior to the auction’s DY.

The third incremental auction (3rd IA) for the 2024/2025 DY is scheduled to open on February 27, 2024 and close on March 4, 2024. It’s anticipated that PJM will post the 3rd IA results on March 11.

Carolyn’s Campaign

Carolyn celebrated her 42nd birthday and held her final fundraiser before her March 19 primary. The event was a success, with over 100 in attendance, including Congressman Dave Joyce and many prominent Geauga County elected officials. Thanks to everyone who has supported Carolyn so far.

Over the next month, the campaign will need to expend a great deal of resources so we can’t thank everyone enough for their continued support. Feel free to reach out to Carolyn with any questions about the campaign or well wishes.

Residential Corner

The best offer we are currently seeing is from Better Buy Energy for nine months at a rate of 5.39¢/kWh. Although relatively inexpensive to other offers, Better Buy Energy is carving out expensive winter 2025 months by not making it a full year offer.

Regarding natural gas, if you entered into a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

The NYMEX price for February settled at $2.490 per Million British Thermal Units (MMBtu) on January 29, 2024. This price is down 4.9% from the January 2024 price of $2.619 per MMBtu. This settlement price is used to calculate February gas supply costs for customers that contract for a NYMEX-based index gas product.

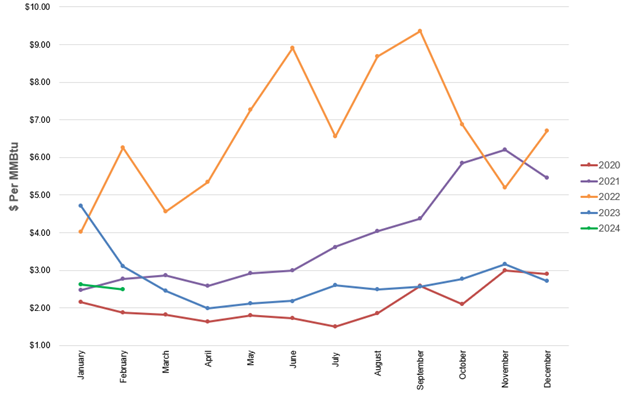

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

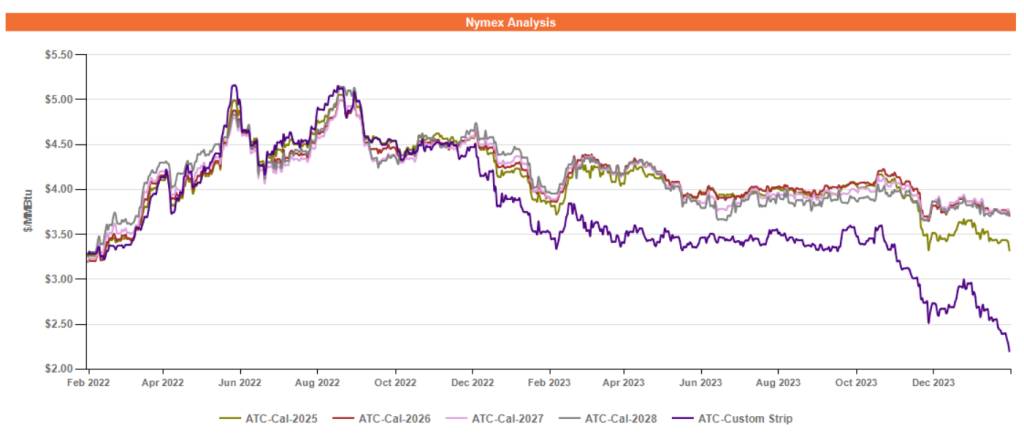

Figure 2 below shows the historical February 15, 2022 through February 15, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas pricing reflects (1) a relative supply and demand imbalance, caused primarily by weather forecasts calling for mild temperatures to persist until at least early March; and (2) natural gas production rebounding to near record levels after a brief decline due to Winter Storm Gerri. This relative glut in supply has mostly impacted the balance of 2024, with less of an effect on outlying years.

Electricity Market Update

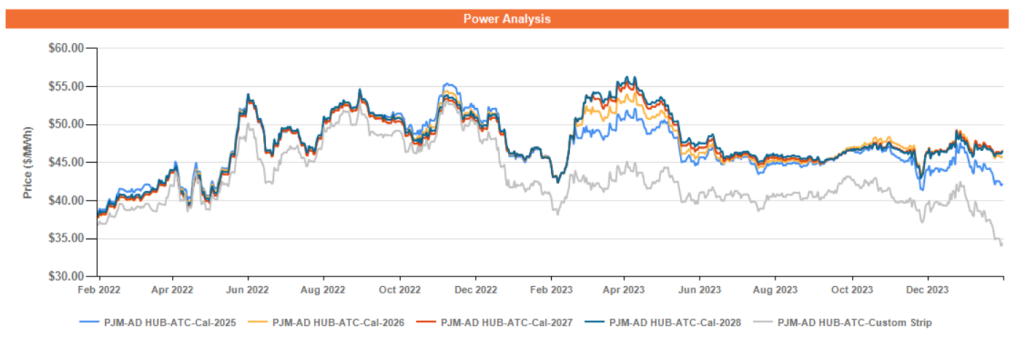

Figure 3 below shows the historical February 15, 2022 – February 15, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Following much the same trend as forward gas pricing, forward power pricing has seen notable softness after a brief increase due to Winter Storm Gerri in mid-January. Forward power pricing for the balance of 2024 is currently trading at levels not seen since before the Russian invasion on Ukraine, and while there has also been softness in 2025 pricing, outlier years remain relatively stable.