Ohio Energy Report: December 2024

PUCO Approves FirstEnergy’s Return to ESP IV with Modifications

On December 18, 2024, the Public Utilities Commission of Ohio (PUCO) issued a Finding and Order (“Order”) in two of FirstEnergy’s (FE) rate cases: 23-301-EL-SSO and 14-1297-EL-SSO. The first concerns FE’s withdrawal of their Fifth Electric Security Plan (ESP V), while the second addresses proposed tariff modifications under the Fourth Electric Security Plan (ESP IV).

In its first Order, the PUCO upheld FE’s statutory right to withdraw ESP V, officially terminating it as of December 18. In the second Order, the PUCO ruled that the terms of ESP IV would be reinstated with certain modifications, following the precedent set in Dayton Power and Light’s (now AES Ohio) Third ESP withdrawal case. However, the Ohio Supreme Court is currently deliberating what should take effect when an ESP is withdrawn: the previous ESP or a market rate offer stripped of utility-specific riders and programs.

Under FE’s reversion to ESP IV, the PUCO deemed modifications to ESP IV tariffs necessary to “protect the public interest, maintain reasonable rates, ensure the integrity of existing contracts, and safeguard Ohio’s competitive bid process for wholesale power procurement.” Approved modifications include:

1. Continuation of the Non-Market-Based Services Rider Pilot Program and expansion to customers with supplier agreements handling transmission billing before the return to ESP IV.

2. Continuation of the Economic Load Response (ELR) Rider’s annual adjustment to firm service levels without altering curtailable load.

3. Retention of changes made to the standard service offer (SSO) procurement process implemented during ESP V.

4. FE’s stewardship program commitment of $3 million annually, without cost recovery, to support economic development and energy conservation, rolling forward any unused amounts as of May 31, 2024.

5. A base distribution rate freeze until a new SSO under ESP VI is implemented.

6. Continuation of the Delivery Capital Recovery Rider, but without the annual revenue cap increase proposed by FE.

New tariffs under ESP IV must be filed by January 2, 2025, and may take effect on that date. If you have questions about how FE’s reversion to ESP IV may affect your electric costs, please contact Katie Emling.

Amazon Announces $10 Billion Investment in Ohio Data Centers

On December 16, 2024, Amazon announced plans to invest $10 billion in building up to eight data centers in Ohio by 2030. This move highlights the appeal of Ohio’s deregulated electricity market and its infrastructure readiness.

In a recent article published in Crain’s Cleveland Business, Matt Brakey commented that while the announcement may have surprised some, he had anticipated such an expansion due to Amazon’s active role in Ohio’s regulatory processes and the state’s reputation as a data center hub.

Brakey noted that while Amazon’s expansion is undoubtedly good news for many—it could also contribute to rising electricity prices. Wholesale rates in Ohio are already trading at a 20% premium come 2028, and capacity prices are set to spike ninefold on June 1, 2025. Ohio datacenter investments like Amazon’s are putting upward pressure on energy and capacity costs alike.

Following PJM’s most recent Base Residual Auction, the anticipated growth in data center electricity demand underscores the need for market-driven investments in reliable, non-intermittent power generation, such as nuclear and gas-fired plants. Brakey expressed hope that the market signals driven by data centers and other variables will lead to increased investment in Ohio’s energy generation capacity and its transmission infrastructure.

AES Ohio Files Base Distribution Rate Case

On November 29, 2024, AES Ohio filed a new base distribution rate case with the Public Utilities Commission of Ohio (PUCO) which could lead to higher prices for most customers. The last time AES Ohio filed an application to increase its base distribution rates was on October 30, 2020.

AES Ohio states in its application that its current revenue is insufficient to yield reasonable compensation for the service it provides to more than 527,000 customers in West Central Ohio. Therefore, the electric distribution utility has requested an increase to its annual revenue requirement of $235.2 million. In addition to proposing changes to its base distribution rates, AES Ohio has also proposed a new rate class for non-residential electric vehicle charging stations called the “Public DC Fast Electric Vehicle Charging Station.

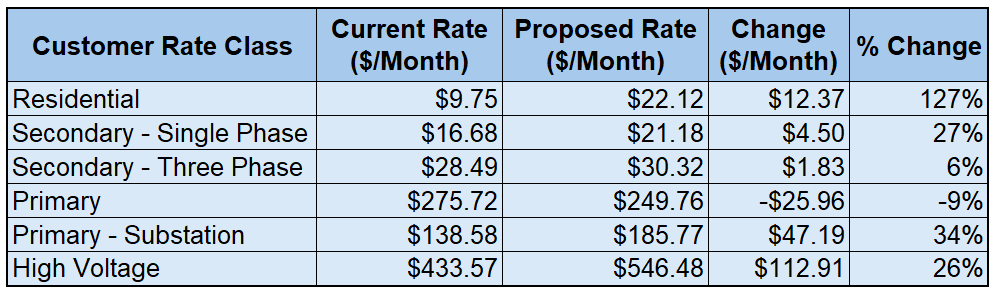

Table 1 below summarizes the current and proposed monthly service charges for AES Ohio Residential, Secondary, Primary, Primary-Substation, and High Voltage customers. AES Ohio has also proposed rate changes to the Private Outdoor Lighting and Street Lighting rate classes not summarized here.

Table 1: AES Ohio’s Current and Proposed Customer Service Charges by Rate Class

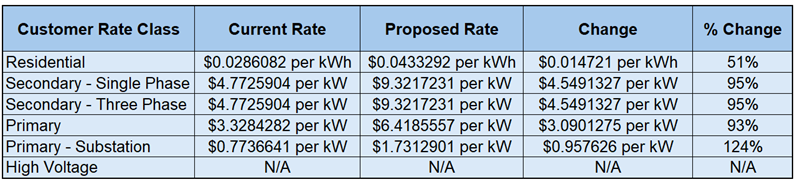

Table 2 below summarizes the current and proposed monthly base distribution energy per kilowatt-hour (kWh) or demand charges per kilowatt (kW) for residential and non-residential customers, respectively.

Table 2: AES Ohio’s Current and Proposed Base Distribution Demand Charges by Rate Class

In addition to the proposed changes to the monthly customer service charge and the base distribution energy and demand charges, AES Ohio has proposed to increase the reactive demand charges for primary and primary-substation rate classes by $0.7804872 per reactive kilovolt-amperes (rkVA) and $0.2164288 per rkVA, respectively.

If you have any questions about how AES Ohio’s proposed rate changes will impact your electric costs, please contact Katie Emling.

FirstEnergy Files Updates to SSO Riders

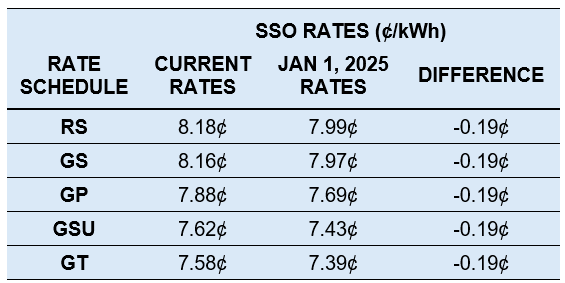

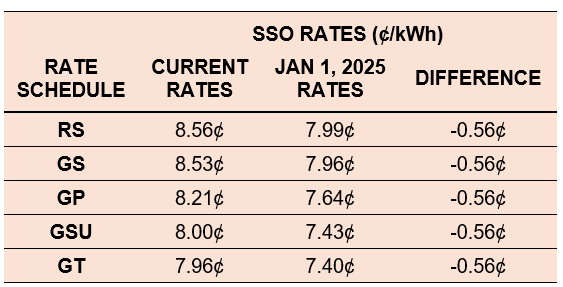

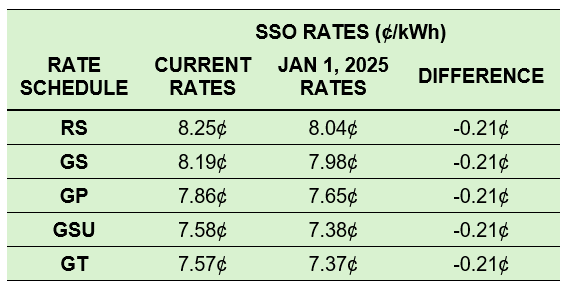

Electric costs will be decreasing slightly on January 1, 2025 for Ohio customers that take electric generation service under FE Standard Service Offer (SSO). The SSO is the default rate charged by the utility for electric generation service to customers that do not contract with an alternative supplier. The SSO generation rate is higher in the three summer months of June, July, and August than it is in the other nine months of the year.

The current and January 1 SSO rates for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. These rates will change again on April 1, 2025.

Table 3: OE SSO Rates

Table 4: CEI SSO Rates

Table 5: TE SSO Rates

If you would like more information about how FE’s SSO rate updates will impact your monthly electric costs, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. Customers looking to hide on a low short-term rate through the winter can contract with American Power & Gas for three months at an artificially low 4.39¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

Regarding natural gas, if you entered a fixed-price residential natural gas contract without an early termination fee — such as those Brakey Energy has previously highlighted — you should consider exiting the contract and either (1) entering a new agreement or (2) defaulting to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

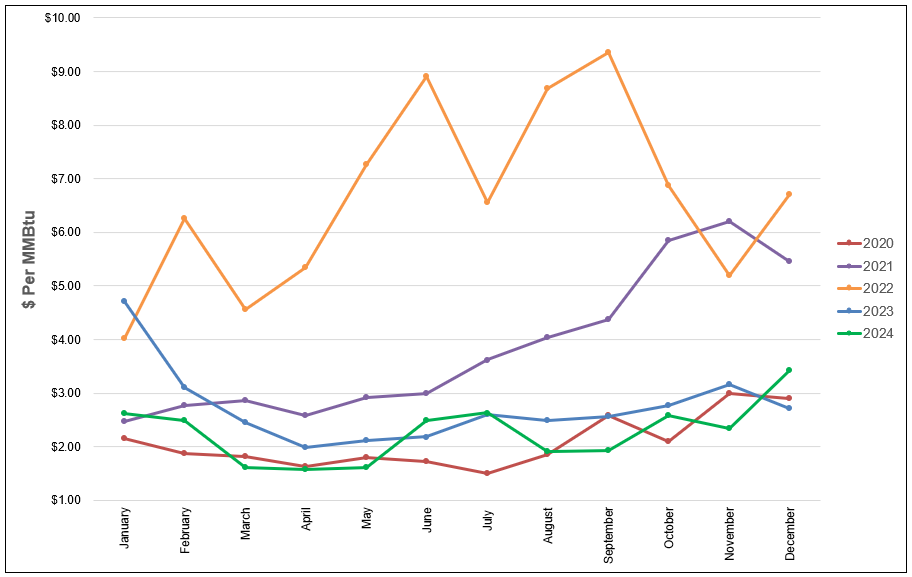

The NYMEX price for December 2024 settled at $3.431 per Million British Thermal Units (MMBtu) on November 26, 2024. This price is up approximately 46.2% from the November 2024 price of $2.346 per MMBtu. This settlement price is used to calculate December gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

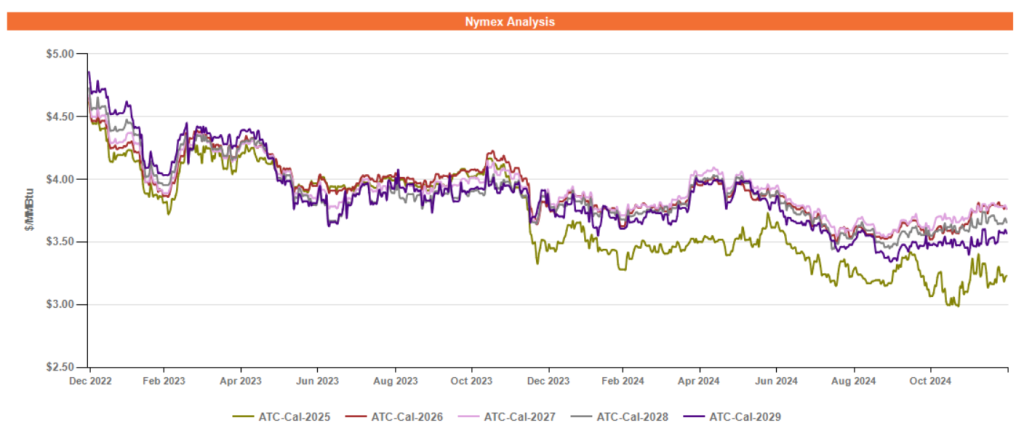

Figure 2 below shows the historical December 20, 2022 through December 20, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for calendar years 2025, 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices in the short term through 2025 have experienced elevated volatility since early November as short-term temperature forecasts have swung between seasonably cold and mild. There was a relatively large storage withdrawal of 190 billion cubic feet (BCF) for the week ending December 6, and gas in storage currently sits 0.6% above last year and 3.8% above the 5-year average at this time of year.

Meanwhile, forward gas prices in 2026-2027 have begun to rise in recent weeks as the outlook for increased LNG export capacity has shifted into these years as a result of delays in construction of LNG export terminals, most notably Golden Pass. By the end of 2025, US LNG export capacity is expected to reach 18.91 BCF/day, rising to 23.84 BCF/day by the end of 2027.

Electricity Market Update

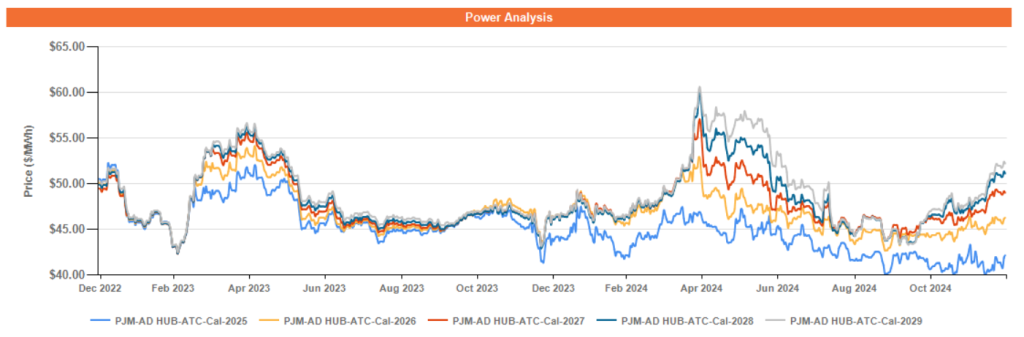

Figure 3 below shows the historical December 20, 2022 through December 20, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for calendar years 2025, 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Forward power prices in the short term have reflected the volatility seen in short-term gas forward prices through 2025, but to a lesser degree. With gas storage levels healthy, meteorologists standing by their mild winter forecasts, and highly elevated Capacity rates coming in the second half of 2025, forward power prices between now and May 2026 have remained stable at or near their 2-year lows.

Forward power prices in outlier years, from June 2026 onward, have begun an uptrend since PJM’s October announcement of further delays in BRA auctions for the 2026/2027 Delivery Year and beyond. The expected LNG export increases coming in 2026-2027, combined with the uncertainty surrounding Capacity rates in outlier years, has led to the formation of a large risk premium for these years compared to 2025. The 2026/2027 BRA auction is currently scheduled to take place in July 2025, and forward power prices in outlier years will likely remain volatile until that auction takes place and informs market participants of the trends in Capacity rates going forward.

Calendar of Events

OHIO’S 29TH ANNUAL OHIO CHAMBER OF COMMERCE ENERGY SYMPOSIUM

Tuesday, February 11, 2025 – Wednesday, February 12, 2025

The Columbus Renaissance Hotel

50 North Third Street

Columbus, Ohio 43215

This is Ohio’s premier conference on energy rates, regulations, and efficiency. Make plans to attend this conference and receive priceless insights into energy prices, trends, savings opportunities, and the forces that influence the price and quality of energy in Ohio.

A link to the conference agenda and registration is located here.