Ohio Energy Report: August 2024

Matt Brakey Files Testimony in Enbridge Gas Ohio 2023 Base Rate Case

On August 9, 2024, regulatory counsel for the Ohio Energy Leadership Council (OELC) submitted the direct testimony of Matt Brakey in Enbridge Gas Ohio’s base rate case before the Public Utilities Commission of Ohio (PUCO). Enbridge, formerly Dominion Energy Ohio, filed its base rate case application on October 31, 2023.

In his testimony, Matt discussed the potential bill impacts of Enbridge’s proposed rate changes to commercial and industrial customers, as well as how those potential bill impacts would be altered under the proposals and recommendations set forth in the PUCO Staff’s Report that was issued in response to this case.

Matt supports the customer service charges proposed by Staff because they would lead to a smaller rate increase compared to what Enbridge proposed in its application. However, he opposes the base volumetric delivery rate changes proposed by both Enbridge and Staff. Instead, Matt recommended adjustments to the base volumetric delivery rates for non-residential rate classes to align with Enbridge’s cost of service study, in addition to other recommendations and analysis discussed in more detail in Matt’s testimony.

The hearing in the case initially slated for a September start has been rescheduled to begin on November 13, 2024.

The PUCO has also scheduled three public hearings in the case that will be held on September 18, 19, and 23, 2024 in Cleveland, Akron, and Lima, respectively. Those that testify will have their comments included in the case record. If you are interested in learning more about these public hearings or how to submit written public comments in the case, please contact Katie Emling.

Capacity Costs Will Surge Beginning June 2025 for Most Ohio Customers

On July 30, 2024, PJM Interconnection (PJM) announced the results for its Planning Year 2025/2026 Base Residual Auction (BRA). Please see our Brakey Energy Update that we issued shortly after the auction results were issued.

Customers who competitively source power, use community aggregations, or default to their utility’s standard service offer are all going to feel the increase in some manner. As Matt Brakey stated in a recent article for Cleveland.com, “There’s not going to be any place to hide from this.” Matt also shared similar sentiments in an article published today by Crain’s Cleveland Business.

Non-residential customers currently contracted for generation contracts that pass through the capacity subcomponent will see this increase in capacity charges based on their Peak Load Contribution (PLC) value for the 2025/2026 DY, which will be based on how you consume power during the five coincident peaks (5CPs) that are set during this summer (i.e., June 1, 2024 – September 30, 2024). The 5CPs are the five hours (occurring on unique days) each summer when the PJM grid peaks.

Many non-residential customers who entered into fixed price contracts may likely come to find that their suppliers will be passing this cost increase on to them as well through unique terms and conditions within all-inclusive fixed price contracts.

Customers that have interruptible capability should give serious consideration to contracting for an emergency demand response program to help offset these high capacity charges.

If you have questions about how you may be impacted by the BRA price for the 2025/2026 DY or are interested in exploring emergency demand response, please contact Brandon Powers.

Peak Loads for Summer 2024

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to those clients that elect to receive them. As of August 29, 2024, Brakey Energy has issued 16 Capacity CP alerts, 13 FE (ATSI Zone) Transmission CP alerts, and 12 AEP Ohio CP alerts during Summer 2024. Brakey Energy also issued three winter alerts for the AEP Zone in January of this year.

Capacity CPs occur during the five one-hour intervals when demand on the PJM grid is at its highest. Transmission CPs for FE customers occur during the five one-hour intervals when demand on FE’s zonal grid is at its highest. The Transmission CP for AEP customers occurs during the one-hour interval when demand on AEP’s zonal grid is at its highest.

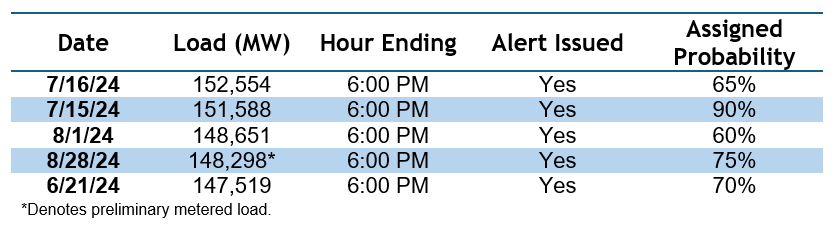

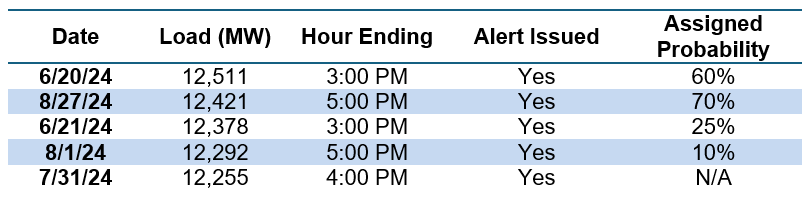

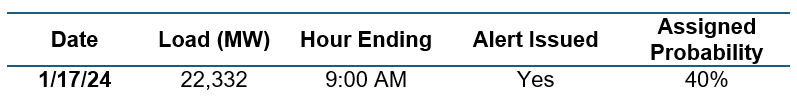

The tables below list PJM’s and FE’s five highest loads and AEP’s single highest load this year, as well as the day and time of each occurrence. This is based on preliminary data.

Table 1: Five Highest Loads for PJM through August 28, 2024

Table 2: Five Highest Loads for FE through August 28, 2024

Table 3: Single Highest Load for AEP through August 28, 2024

In our 2024 Coincident Peak Forecasting Report, we forecasted that the 1CP and 5CP for PJM will be 147,216 Megawatt (MW) and 138,860 MW, respectively, and that the 1CP and 5CP for FE would register at 12,448 MW and 11,928 MW, respectively. PJM’s and ATSI’s top five peak loads to date have fallen within or above those respective ranges. The summer CP season ends on September 30.

In our 2024 Coincident Peak Forecasting Report, we discussed the strong likelihood that the load during the HE 9:00 AM on January 17, 2024 may end up setting the 1CP for the AEP Zone between November 1, 2023 and October 31, 2024. Although PJM load forecasts have exceeded the metered peak load on January 17 on a number of occasions this summer, metered load has not yet registered above 22,332 MW. We suspect that this is due in large part to customers in the AEP Zone managing their loads during potential capacity CPs.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted. If you are a Brakey Energy client that has not signed up for these alerts but would like to, please email Catherine Nickoson.

Residential Corner

The sky-high BRA auction clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. If you are in a pinch and have a contract approaching expiration, we recommend hiding out with Better Buy Energy on its nine-month offer for 5.49¢/kWh. Unfortunately, absent a major crash in energy prices, residential ratepayers are going to be looking at significantly higher rates beginning summer of next year.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

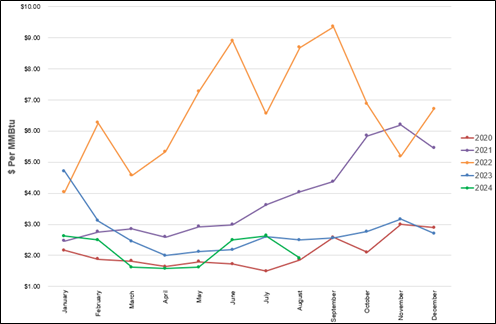

The NYMEX price for August settled at $1.907 per Million British Thermal Units (MMBtu) on July 29, 2024. This price is down 27.4% from the July 2024 price of $2.628 per MMBtu. This settlement price is used to calculate August gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

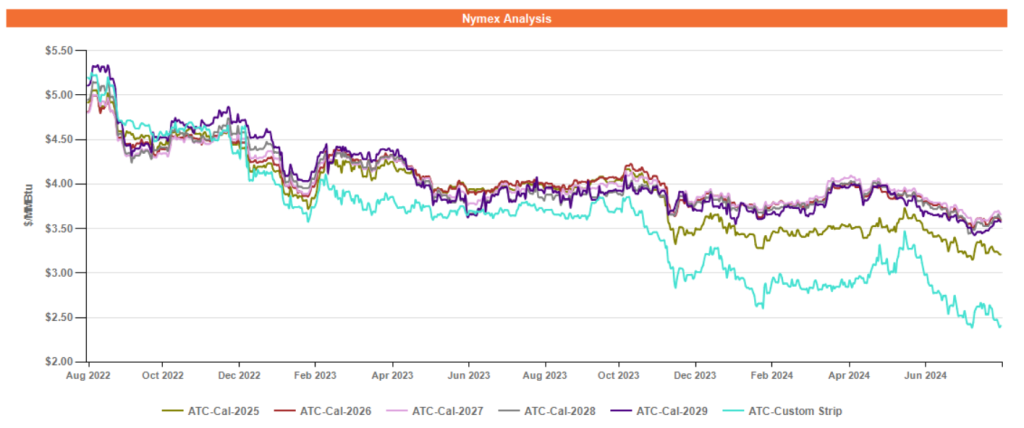

Figure 2 below shows the historical August 29, 2022 through August 29, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Price action in the forward gas market this summer has reflected the changing landscape of natural gas demand, production trends, and LNG export facility construction. The Golden Pass LNG export hub has incurred more delays, and operations are now slated to begin in the second half of 2025 as opposed to the first half.

Despite this summer’s heatwaves, total gas demand nationwide has been roughly equivalent to last year, including power burn demand. In order to help manage the relative storage glut, large producers such as EQT Resources recently announced production cuts. Gas in storage currently sits approximately 7% above last year at this time and 13% above the 5-year average for this time of year.

Electricity Market Update

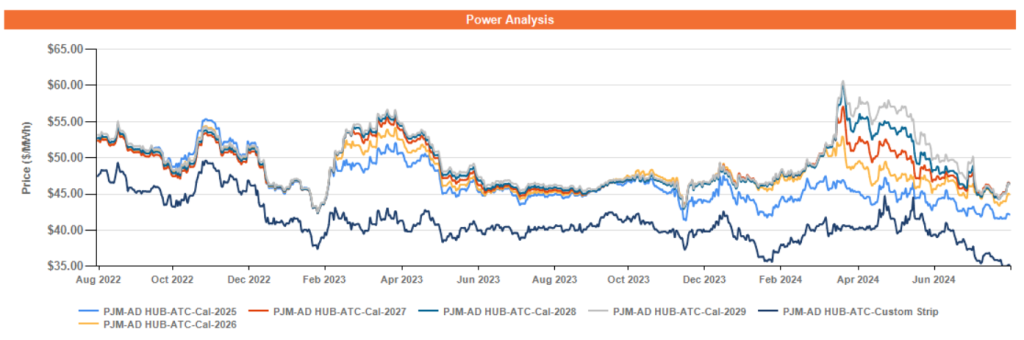

Figure 3 below shows the historical August 29, 2022 through August 29, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Volatility in forward power prices has lessened since the start of the summer, particularly for the short term through 2025. The intermittency of the heatwaves experienced this summer and the wide availability of affordable gas have kept the short-term forward power market stable.

Meanwhile, forward power prices in the long term in 2026 and beyond have softened significantly since the start of summer, due in large part to the surprising results of PJM’s recent BRA capacity auction. Capacity prices are expected to continue to clear at elevated levels in subsequent auctions to be held later this year and early next year. All things equal, higher capacity prices have a depressant effect on forward power prices, as generators are able to recoup their costs via increased capacity payments rather than primarily through electricity generation.