Ohio Energy Report: February 2025

FirstEnergy Files ESP VI Application

On January 31, 2025, FirstEnergy (FE) filed an application for its Sixth Electric Security Plan (ESP VI) with the Public Utilities Commission of Ohio (PUCO). FE has proposed that this plan begin when its new base distribution rates take effect and remain in place through May 31, 2028. Since FE’s 2024 Base Rate Case filed on May 31, 2024 is still pending before PUCO, there is no definite timeline for when new base rates will go into effect.

FE’s ESP VI application is modeled after its Fifth Electric Security Plan (ESP V), which the PUCO approved with modifications on May 15, 2024. However, ESP VI includes additional modifications to certain distribution-related riders that FE states will support system reliability, affordability, and customer assistance.

For commercial and industrial customers, FE has proposed maintaining its Non-Market-Based Services Rider Opt-Out Pilot Program (“Transmission Pilot Program”) and its interruptible program, known as the Economic Load Response Rider (Rider ELR). FE intends to continue these programs with modifications approved in ESP V, including a phase down of Rider ELR credits, which temporarily returned to $10 per kilowatt of curtailable load on February 1, 2025, following FE’s reversion to its Fourth Electric Security Plan.

Additionally, FE has proposed to:

- Continue its capital investment riders, consistent with ESP V rate design, but with increased cost caps;

- Reintroduce an enhanced vegetation management program; and

- Reinstate riders for storm response and vegetation management expenses, previously approved in ESP V.

Other key provisions in FE’s ESP VI application include:

- The continuation of FE’s competitive bidding process for its standard service offer;

- The continuation of FE’s residential energy efficiency program; and

- A proposal to contribute $6.5 million annually, without cost recovery from customers, to support electric vehicle adoption programs and bill payment assistance for low-income and senior citizen customers.

Brakey Energy will provide updates on this case in future newsletters. If you have any questions about how FE’s ESP VI proposals may impact you if approved, please contact Katie Emling.

PJM Proposes Capacity Auction Price Collar in FERC Filing

On February 20, 2025, PJM Interconnection (PJM) submitted a filing to the Federal Energy Regulatory Commission (FERC) under Section 205 of the Federal Power Act, requesting a price cap of approximately $325 per megawatt (MW)-day and a price floor of $175 per MW-day. This proposed Base Residual Auction (BRA) price collar would apply to all capacity auctions for the 2026/2027 and 2027/2028 Delivery Years (DY).

The filing follows an agreement PJM reached with Pennsylvania Governor Josh Shapiro, who sued FERC in December 2024 to prevent historic price hikes in upcoming capacity auctions. PJM has requested FERC approve the filing by March 31, 2025.

This is the latest in a series of FERC filings aimed at balancing reliability and cost-effectiveness as PJM and stakeholders work on long-term solutions to address supply-demand imbalances.

On February 14, 2025, FERC approved other capacity market rule changes for the next two PJM auctions, including a significant provision allowing PJM to recognize qualifying Reliability Must-Run (RMR) units as price-takers in the auctions. RMR units are generators scheduled for retirement but kept operational temporarily to maintain grid reliability. After PJM’s 2025/2026 DY BRA intervenors such as the Sierra Club argued that excluding RMR units had driven up capacity costs by billions.

PJM’s third incremental auction for the 2025/2026 DY opened on February 26, 2025, with results expected on March 11. The next major auction, the BRA for the 2026/2027 DY, is scheduled to begin in July 2025.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. Customers looking to hide on a low short-term rate through the winter can contract with American Power & Gas for three months at an artificially low 4.59¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a unconscionably high holdover provision!

Regarding natural gas, if you entered a fixed-price residential natural gas contract without an early termination fee — such as those Brakey Energy has previously highlighted — you should consider exiting the contract and either (1) entering a new agreement or (2) defaulting to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

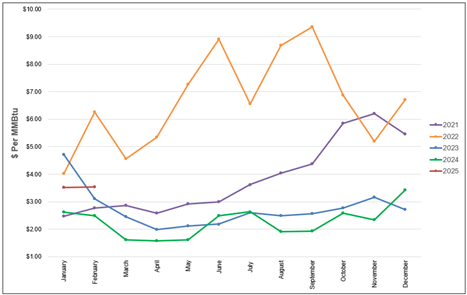

The NYMEX price for February settled at $3.535 per Million British Thermal Units (MMBtu) on January 29, 2025. This price is up 0.6% from the January 2025 price of $3.514 per MMBtu. This settlement price is used to calculate February gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year to date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

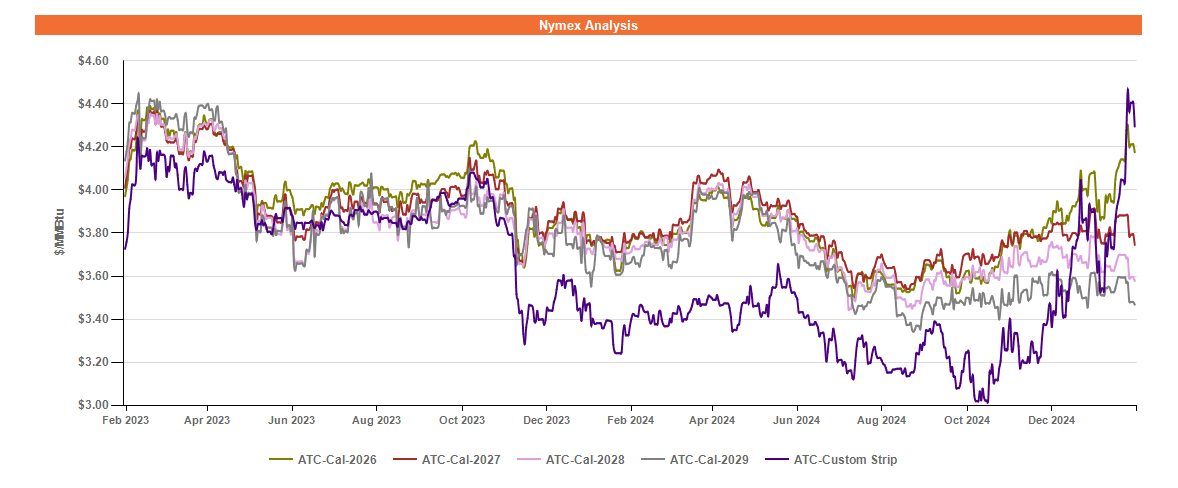

Figure 2 below shows the historical February 26, 2023 through February 26, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices in the short-to-medium-term have risen markedly since December 2024, as weather conditions this winter have proven to be more severe than meteorologists had forecasted in the fall. Of the five weekly gas storage withdrawals in January 2025, two were large enough to be included in the top 10 weekly storage withdrawals since 1994. In addition, sub-zero temperatures in the southern and middle US led to pipeline freezes and a steep drop in production in late January through early February. While gas storage had been in a state of surplus for two years, helping to keep prices low, levels have now dipped below the five-year average, driving up prices. As a result, the forward gas market is now in a state of pronounced backwardation, where prices through the balance of 2025 and through 2026 are trading at higher prices than 2027-2029.

Electricity Market Update

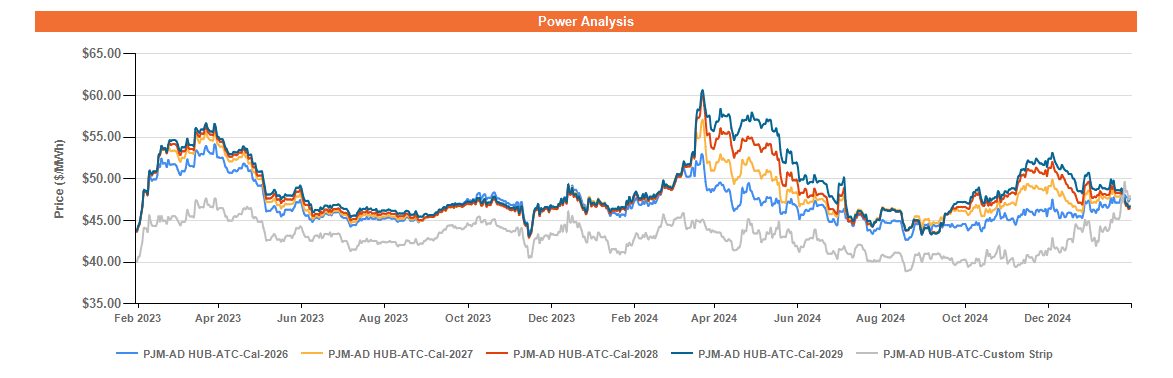

Figure 3 below shows the historical February 26, 2023 – February 26, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Forward power prices overall have risen over the past month due to the colder-than-expected winter temperatures depleting gas storage, which has affected the front end of the curve more than outlier years 2027 and beyond. As a result, forward power prices through 2026 are now trading at a slight premium to 2027-2029, though this state of backwardation is not as pronounced as in the forward gas market.

In outlier years 2027 and beyond, forward power prices reflect broader fundamental factors such as increased electricity demand from new data centers, manufacturing reshoring, and increased electrification. Forward price volatility in these years has declined as the proposed BRA capacity price collar attempts to bring some visibility to capacity prices beyond May 31, 2026. All things equal, higher capacity prices have a depressant effect on forward power prices, as generators are able to recoup their costs via increased capacity payments rather than primarily through electricity generation.