Ohio Energy Report: January 2025

AEP Zone Load Registers Possible 1CP in Arctic Blast

Brakey Energy provides email and text alerts in advance of loads having the potential to set the year’s American Electric Power (AEP) Zone Transmission Coincident Peak (CP, or 1CP) to clients enrolled in AEP’s Basic Transmission Cost Rider (BTCR) transmission pilot program. In mid-January, an arctic blast swept across the country, sending much of the AEP Zone into subzero temperatures. As a result, Brakey Energy issued three AEP Zone Transmission CP alerts from January 20–22, 2025, and two additional alerts earlier in the month, on January 10 and 15.

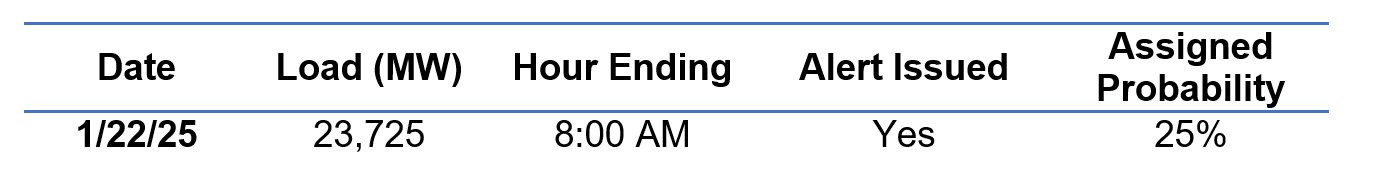

As shown in the table below, the preliminary metered load on January 22 set the highest peak load to date in the AEP Zone since the current CP year began on November 1, 2024.

Table 1: Single Highest Load for AEP Zone through January 28, 2025

Brakey Energy estimated that the 1CP for the AEP Zone between November 1, 2024, and October 31, 2025, would be 22,266 megawatts (MW). The PJM Regional Transmission Organization predicted that AEP’s peak load this winter would reach 23,781 MW. For context, AEP’s 1CP for the previous period (2023/2024) was 22,332 MW.

On January 22, 2025, the preliminary metered load exceeded Brakey Energy’s forecasted peak and last year’s peak by more than 1,000 MW. This highest load recorded so far this winter is only 56 MW below PJM’s projected winter peak. Even with the rest of winter and this upcoming summer still to go, we believe it is more likely than not that the hour ending 8:00 AM on January 22, 2025 will prove to be the AEP Zone’s 1CP this year.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted.

FirstEnergy Files April 1, 2025 Update to Non-Market-Based Services Rider

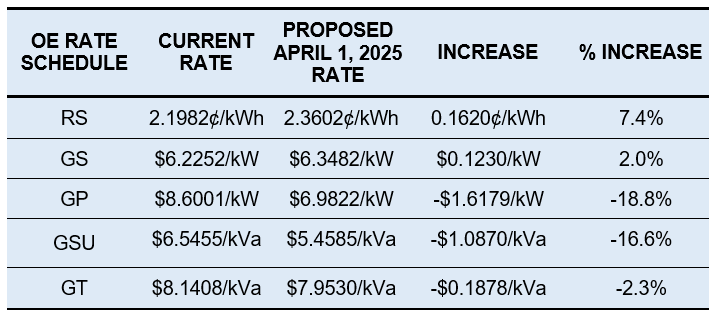

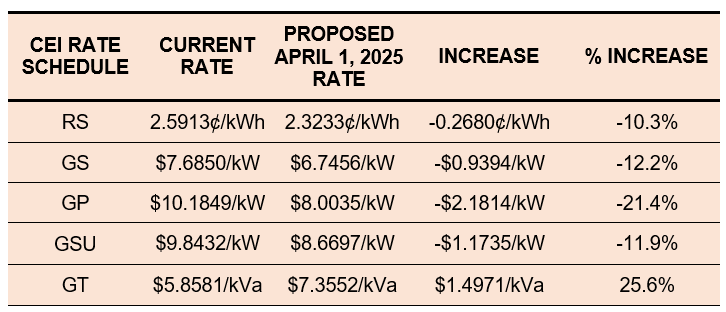

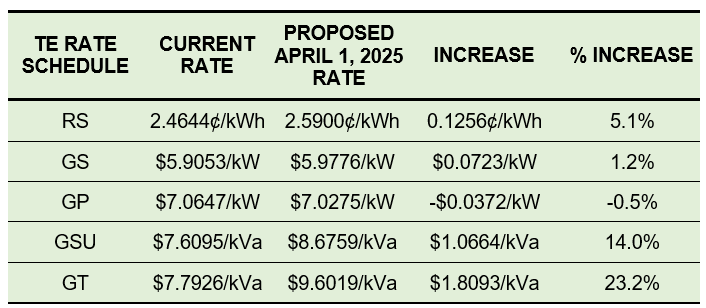

The Non-Market-Based Services Rider (Rider NMB) rates are set to change April 1, 2025 for residential and non-residential customers of FirstEnergy’s (FE) three Ohio operating companies: Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE). Rider NMB recovers FE’s non-market-based costs for transmission and ancillary services, with the largest component being PJM’s Network Integration Transmission Service (NITS) charge.

For 2025, the NITS rate in the ATSI Zone—the transmission zone serving FE’s Ohio customers—is expected to increase by only 1% compared to 2024. Despite the NITS rate remaining near current levels, Rider NMB rates for various operating companies and customer classes will either increase or decrease based on each rate class’s share of the summer 2024 peak loads.

If approved by the Public Utilities Commission of Ohio, the updated Rider NMB rates will take effect on April 1, 2025. Current and proposed April 1, 2025 Rider NMB rates for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. Rates are per kilowatt hour (kWh) for RS customers and per kilowatt (kW) or kilovolt-ampere (kVa) for GS, GP, GSU, and GT customers.

Table 2: OE Rider NMB Rates

Table 3: CEI Rider NMB Rates

Table 4: TE Rider NMB Rates

Clients that are participating in FE’s transmission pilot program are opted out of paying the NMB rider. If you have any questions about this pilot program or how the new NMB rates will impact your electric costs, please contact Katie Emling.

AEP Files April 1, 2025 Update to Basic Transmission Cost Rider

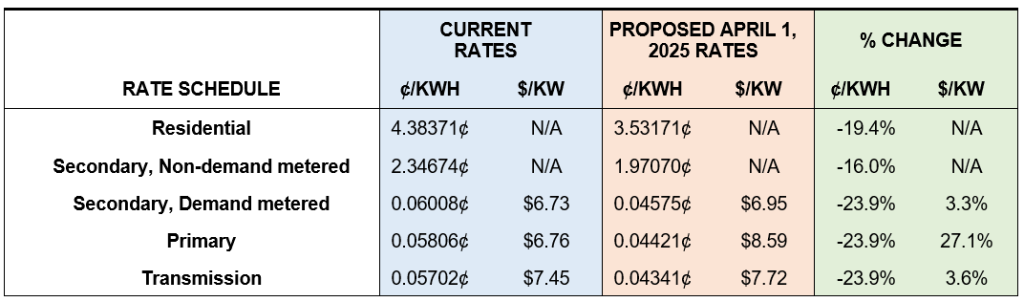

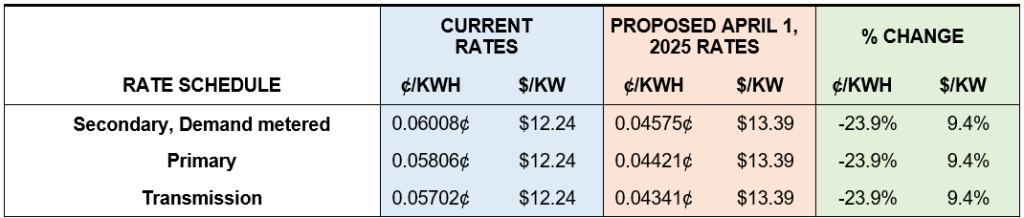

Earlier this month, American Electric Power (AEP) Ohio filed proposed April 1, 2025 rate updates for AEP’s Basic Transmission Cost Rider (BTCR). Based on the filing, the demand-based billing component of transmission costs for the majority of AEP Ohio non-residential customers will be increasing by approximately 3% to 27%, depending on the rate schedule. The energy component rate for each non-residential customer class will be decreasing by approximately 24%. Similarly, residential customers will see a 19% decrease in BTCR charges.

Select interval-metered customers, including Brakey Energy clients, may choose to participate in a transmission pilot program. For participants, the demand portion of BTCR charges is calculated based on the customer’s load during AEP’s 1CP, as opposed to the default method, which uses monthly billed demand.

Demand based BTCR rates for customers participating in AEP’s transmission pilot program will be increasing by approximately 9%.The tables below show the current and proposed April 1, 2025 BTCR kWh and kW-based rates for non-transmission pilot program customers and transmission pilot program customers of AEP-Ohio. The percentage change for each rate is also summarized.

Table 5: Current and Proposed April 1, 2025 BTCR Rates for AEP Ohio Customers

Table 6: Current and Proposed April 1, 2025 for AEP Ohio Customers Participating in the Transmission Pilot Program

If you would like more information about how the BTCR impacts your monthly electric costs, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. Customers looking to hide on a low short-term rate through the winter can contract with American Power & Gas for three months at an artificially low 4.59¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

Regarding natural gas, if you entered a fixed-price residential natural gas contract without an early termination fee — such as those Brakey Energy has previously highlighted — you should consider exiting the contract and either (1) entering a new agreement or (2) defaulting to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

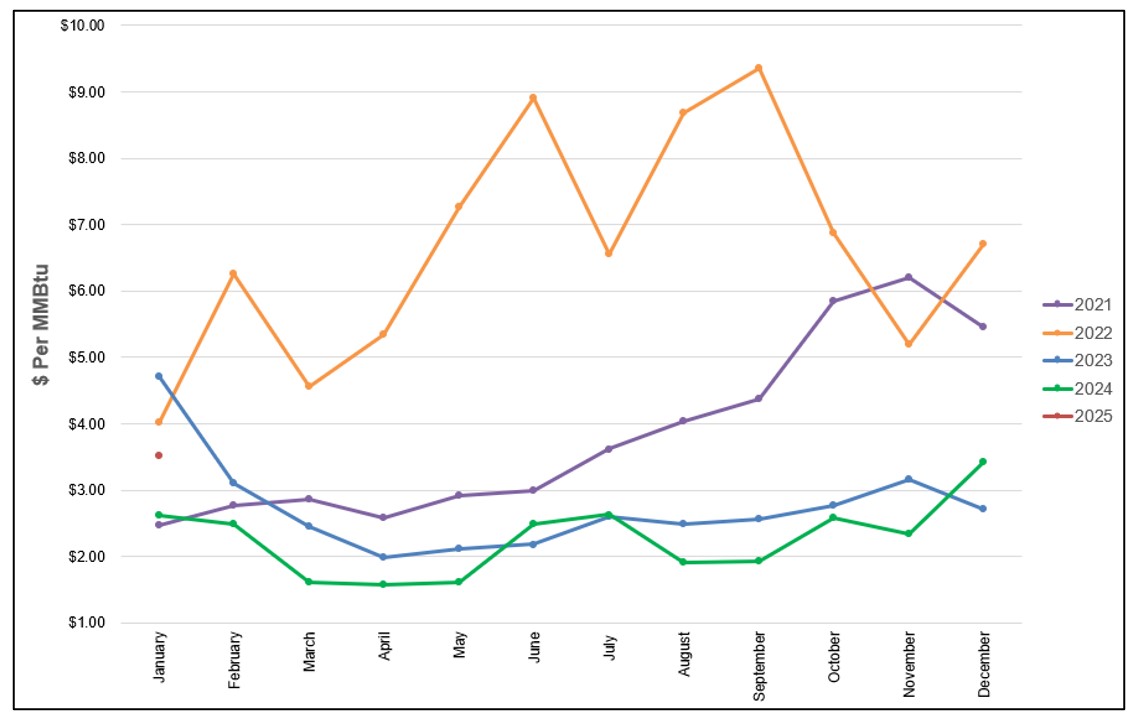

The NYMEX price for January settled at $3.514 per Million British Thermal Units (MMBtu) on December 27, 2024. This price is up 2.4% from the December 2024 price of $3.431 per MMBtu. This settlement price is used to calculate January gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and January 2025. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

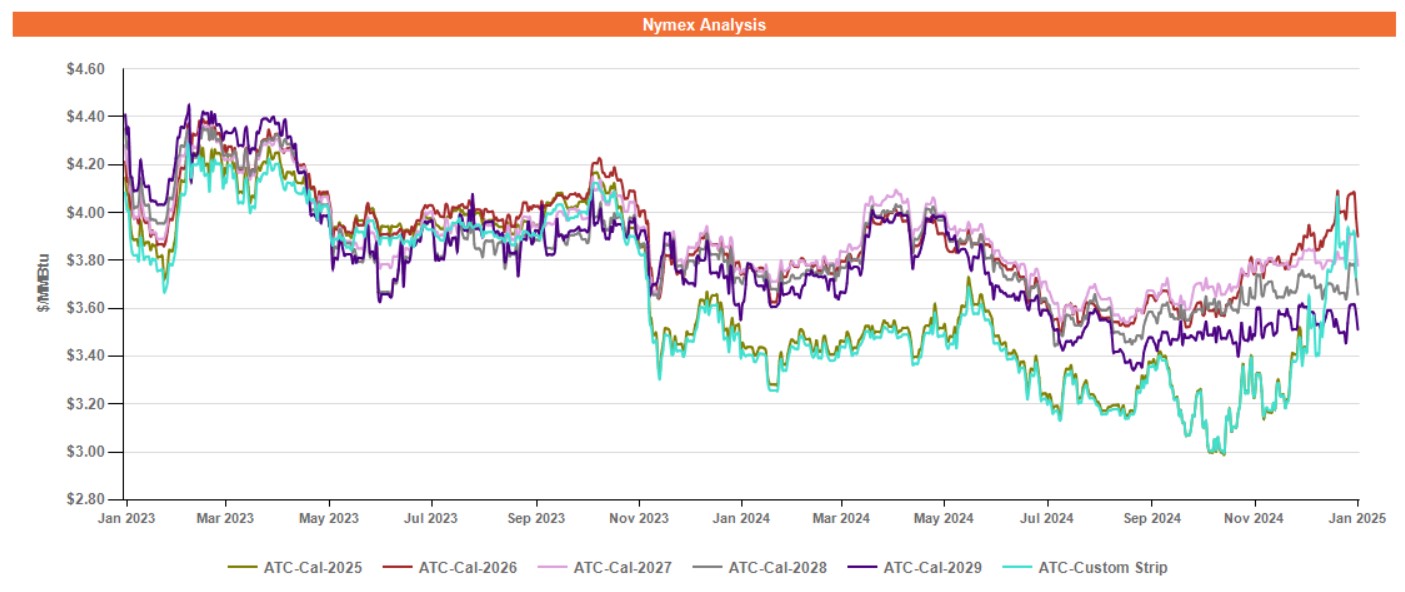

Figure 2 below shows the historical January 29, 2023 through January 29, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices in the short term through 2025 have experienced elevated volatility since December 2024, as weather conditions this winter have so far proven to be more severe than meteorologists had forecasted in the fall. In addition, liquefied natural gas (LNG) export capacity is set to increase markedly through 2025, potentially leaving less gas for the US domestic market than would otherwise be available, and adding upward pressure to forward prices in 2025 through 2027.

Market participants are anticipating the release of the weekly gas storage figures from the EIA on Thursday, January 30, to evaluate the Arctic Blast’s effect on the relative storage surplus compared to the trailing five-year average that has been in place since 2023.

Electricity Market Update

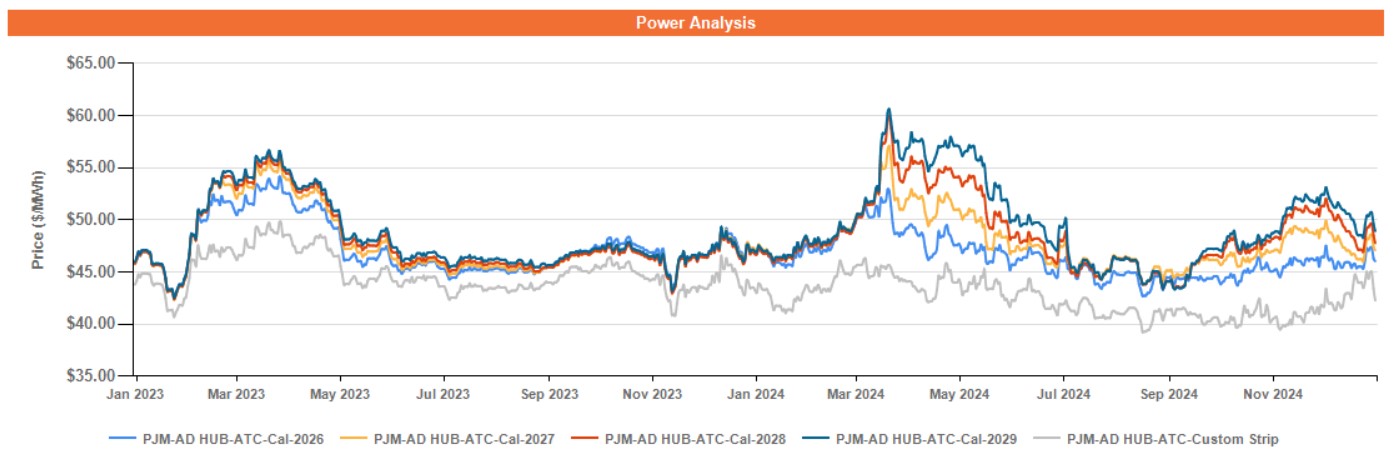

Figure 3 below shows the historical January 29, 2023 – January 29, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Forward power prices in the short to medium term through 2026 have traded close to their two-year lows since late summer 2024, rising in recent weeks due to the impact of a colder-than-expected January that has simultaneously impacted short-term natural gas forward prices. Overall, though, significantly higher Capacity rates that will begin June 1, 2025 have helped to reduce volatility in forward power prices in the short to medium term, as a major subcomponent of generation costs is a known quantity through May 2026.

Forward prices in outlier years 2027 and beyond have risen in reaction to the recent announcement of the Stargate artificial intelligence buildout, backed by President Trump. This announcement has caused market participants to factor in this potentially new and sizable growth in power demand over the next five years, causing a jump in forward prices in these years. Forward power prices in outlier years will likely remain volatile for the foreseeable future as market participants weigh the effects of expansion of LNG export capacity, uncertain Capacity rates in PJM beyond May 2026, and anticipated large load growth from new data center construction.

Calendar of Events

OHIO’S 29TH ANNUAL OHIO CHAMBER OF COMMERCE ENERGY SYMPOSIUM

Tuesday, February 11, 2025 – Wednesday, February 12, 2025

The Columbus Renaissance Hotel

50 North Third Street

Columbus, Ohio 43215

This is Ohio’s premier conference on energy rates, regulations, and efficiency. Make plans to attend this conference and receive priceless insights into energy prices, trends, savings opportunities, and the forces that influence the price and quality of energy in Ohio.

A link to the conference agenda and registration is located here.

Brakey Energy clients may have access to discounted entries to the conference. Please contact Catherine Nickoson for more information.