Ohio Energy Report: September 2024

Peak Loads for Summer 2024

As we approach September 30 — the end of the summer coincident peak (CP) management season — weather and load forecasts indicate that the five coincident peaks for capacity and transmission in the ATSI Zone have been set.

Peak loads for capacity rebounded to loads reached in the summers of 2018 and 2019. Peak loads in the ATSI Zone were comparable to loads reached most recently set in the summer of 2022. The highest preliminary metered load to date for the PJM regional transmission organization exceeded our forecasted peak by 5,338 Megawatts (MW) and the ATSI Zone peak load to date exceeded out forecasted peak by 63 MW.

For customers with electric generation contracts that pass through capacity, capacity costs are allocated according to each customer’s share of the load during PJM’s five regional load peaks (known as “Capacity Coincident Peaks,” or “Capacity CPs”). Likewise, for customers participating in FirstEnergy’s (FE) or AEP’s transmission pilot programs, transmission costs are primarily allocated according to each customer’s share of the load during FE’s or AEP’s respective zonal load peaks (known as “Transmission CPs”). By actively managing load during potential CP events, these customers can mitigate future capacity and transmission costs.

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission CPs to those clients that elect to receive them. As of September 24, 2024, Brakey Energy has issued 16 Capacity CP alerts and 14 FE Transmission CP alerts. We also issued 13 AEP Ohio CP alerts during Summer 2024 and three during this past winter.

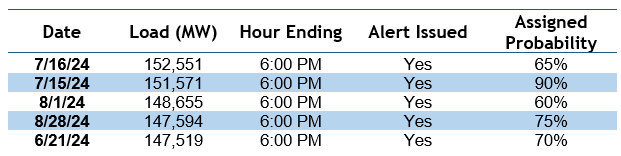

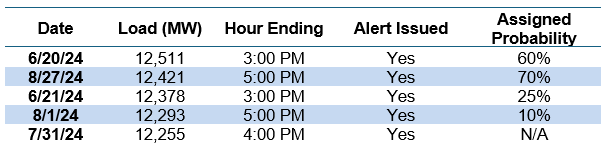

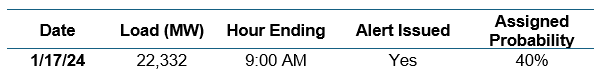

The tables below list PJM’s and FE’s five highest 2024 summer loads and AEP’s single highest load since November 1, 2023, as well as the day and time of each occurrence. This is based on preliminary data.

Table 1: Five Highest Loads for PJM through September 26, 2024

Table 2: Five Highest Loads for FE through September 26, 2024

Table 3: Single Highest Load for AEP through September 26, 2024

Based on current weather forecasts, we do not anticipate any further potential CP events for the CP management year. PJM can adjust metered load data for up to 90 days. Although we did not send a CP Alert the morning of the fifth highest ATSI CP to date, we sent an intraday text alert warning of the higher than forecast loads.

Brakey Energy will continue to monitor metered loads and will provide an update on the Capacity and Transmission CPs once they are finalized by PJM. If you would like to know how your performance during the Capacity and/or Transmission CPs mentioned above will impact your future electric costs, please contact Katie Emling.

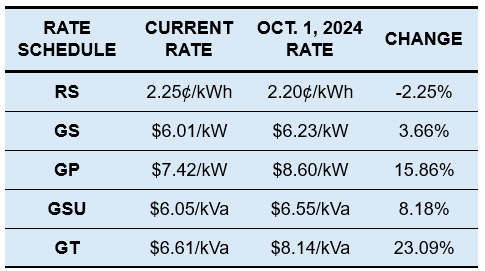

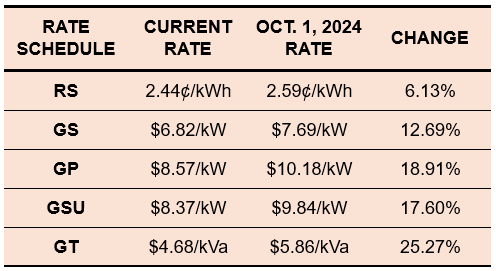

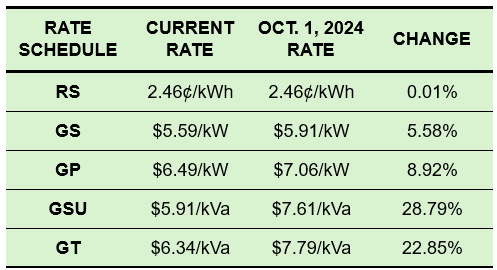

FE Files October 1, 2024 Updates to April 1, 2024 Rider NMB Rates

Transmission costs for Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE) customers, with the exception of OE Residential (RS) customers, will be increasing on October 1, 2024. FE filed a six-month rate update to its April 1, 2024 Non-Market-Based Services Rider (Rider NMB) rates on September 23, 2024. This six-month rate filing was expected based on the Public Utilities Commission of Ohio ‘s ruling to phase in cost increases that would otherwise have gone into effect on April 1, 2024.

Rider NMB is used to recover FE’s nonmarket-based costs for transmission and ancillary services for all customers not enrolled in FE’s transmission pilot program.

October 1, 2024 Rider NMB rates for OE, CEI, and TE RS, Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the table below. Also shown are the current Rider NMB rates that have been in effect since April 1, 2024. Rates are per kWh for RS customers and per kilowatt (kW) or kilovolt-ampere (kVa) for GS, GP, GSU, and GT customers.

Table 4: OE Rider NMB Rates

Table 5: CEI Rider NMB Rates

Table 6: TE Rider NMB Rates

If you have any questions about this pilot program or how the new NMB rates will impact your electric costs, please contact Katie Emling.

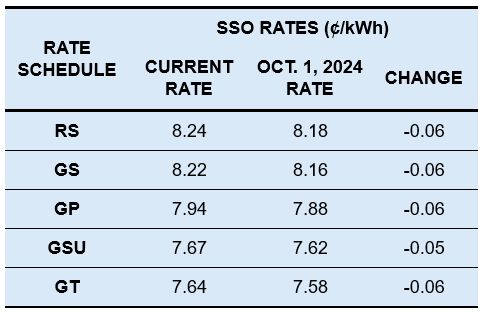

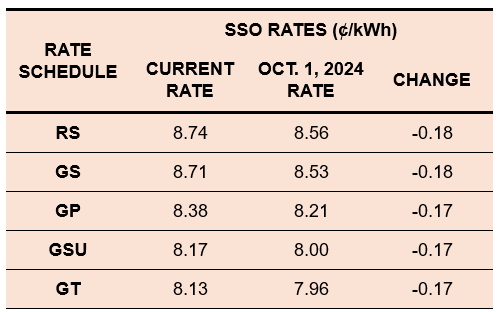

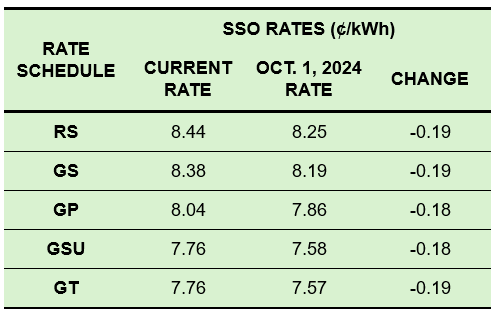

Electric Costs Decreasing on October 1 for FE SSO Customers

Electric costs will be decreasing slightly on October 1 for OE, CEI, and TE customers that take electric generation service under the utilities’ Standard Service Offer (SSO). The SSO is the default rate charged by the utility for generation services to customers that do not contract with an alternative supplier. The SSO generation rate is higher during the three summer months of June, July, and August than it is during the other nine months of the year.

The current and October 1, 2024 SSO rates per kilowatt hour (kWh) for customers served under OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. These rates will change again on January 1, 2025.

Table 7: OE SSO Rates

Table 8: CEI SSO Rates

Table 9: TE SSO Rates

If you are not receiving electric generation service from an alternative supplier and would like more information about how FE’s SSO rate update will impact your monthly electric costs, please contact Katie Emling.

Carolyn Campaign Update

Carolyn is holding two meet-and-greet events with Geauga’s State Representatives Steve Demetriou and Sarah Fowler Arthur.

The Bainbridge Township Meet and Greet with Rep. Demetriou will be held on Monday, October 14 from 5:00 PM – 7:00 PM at Holbrook Hollows Lodge.

The Claridon Township Meet and Greet with Rep. Fowler Arthur will be held on Thursday, October 17 from 5:00 PM – 7:00 PM at the Claridon Woodlands Park Lodge.

Carolyn hopes to see you there. It will be a great opportunity to chat with Carolyn and two of Ohio’s young up-and-coming State Reps!

Residential Corner

The sky-high BRA auction clearing price has resulted in all offers extending beyond June 2025 to be materially higher than shorter term offers. However, there is one attractive offer that will actually take customers through Summer 2025. Clean Choice Energy has a 12-month offer for 5.9¢ per kWh. Unfortunately, absent a major crash in energy prices, residential ratepayers are going to be looking at significantly higher rates beginning summer of next year.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

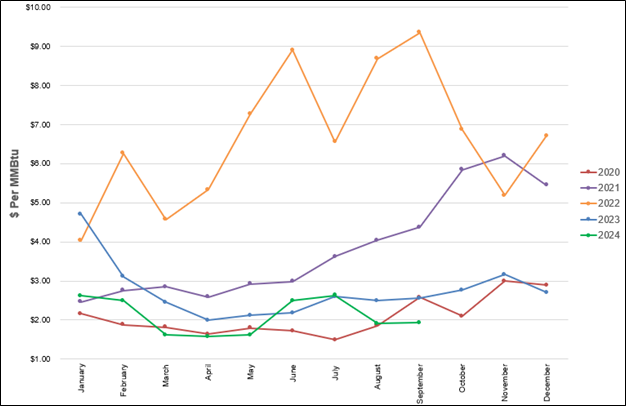

Natural Gas Market Update

The NYMEX price for September 2024 settled at $1.930 per Million British Thermal Units (MMBtu) on August 28, 2024. This price is up 1.2% from the August 2024 price of $1.907 per MMBtu. This settlement price is used to calculate September gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

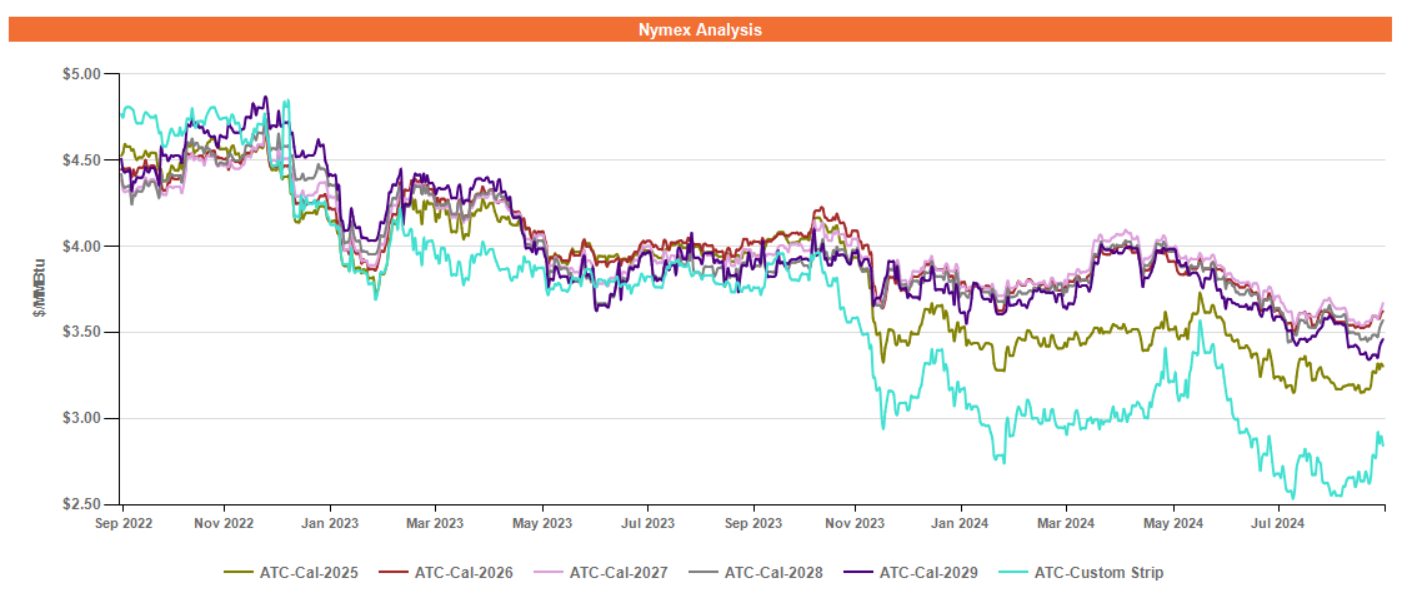

Figure 2 below shows the historical September 27, 2022 through September 27, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Power burn demand for gas has been stable due to relatively warm temperatures in September. There was also a temporary halt in gas and oil production due to Hurricane Francine making landfall in Louisiana earlier this month. As a result, storage injections have been relatively weak in recent weeks, and forward gas prices through 2025 have rallied in response.

Gas in storage currently sits at 4.8% above last year at this time and 7.1% above the 5-year average for this time of year. Injection season will come to a close at the end of October, and the US Energy Information Administration (EIA) forecasts that storage levels will reach 3,954 Billion Cubic-feet (BCF) at season’s end, which would be 6% above the 5-year average and the most gas in storage since November 2016.

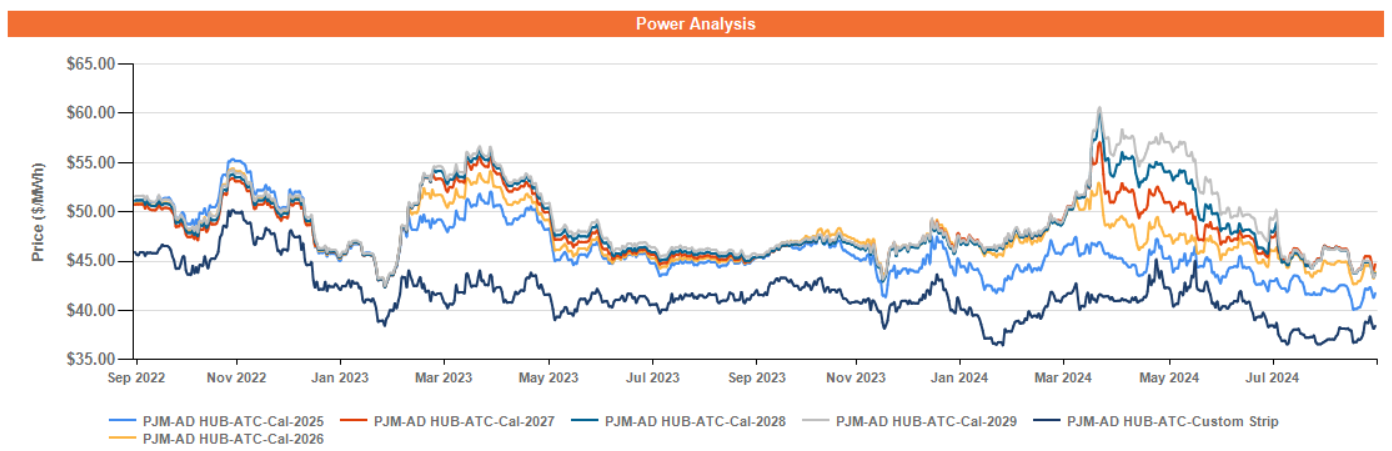

Electricity Market Update

Figure 3 below shows the historical September 27, 2022 through September 27, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Over the past month, volatility in the forward power market has increased, correlating with forward gas prices. Forward power prices in 2025 recently traded to fresh 2-year lows, while calendar years 2026 and beyond revisited 2-year lows. Market participants in both the forward power and forward gas markets are anticipating meteorologists’ preliminary forecasts for the upcoming winter, which are expected to be released in early to mid-October.